FAB Credit Card Balance Check in UAE (2026 Guide): App, SMS, ATM, Phone & Smart Debt Management

In the UAE, banks increasingly assess your credit exposure in real time, not just when you apply for a loan. Something as simple as your credit card balance directly affects your Debt Burden Ratio (DBR), loan approvals, and even mortgage eligibility.

That’s why regularly checking your First Abu Dhabi Bank (FAB) credit card balance isn’t just a convenience – it’s part of responsible financial management.

Whether you’re a resident, tourist, entrepreneur, or investor, this guide explains:

- Every official way to check your FAB credit card balance

- Which method is fastest and safest

- How balances affect UAE lending rules (DBR)

- Practical tips to avoid fees and declines

- Common mistakes people make

First Abu Dhabi Bank (FAB) at a Glance

First Abu Dhabi Bank (FAB) is the largest bank in the UAE by assets and one of the region’s most systemically important financial institutions. It offers:

- Personal banking

- Credit cards and prepaid cards

- Loans and mortgages

- SME & corporate banking

- Digital banking (mobile + online)

Because FAB integrates balances, limits, and liabilities across products, checking your card balance regularly helps you:

- Track spending

- Avoid late fees

- Prevent over-limit penalties

- Maintain a healthy DBR for future borrowing

What Does “Credit Card Balance” Actually Mean?

Before checking, it’s important to understand what you’re seeing.

Your dashboard usually shows:

- Outstanding Balance

Total amount you owe right now (posted transactions) - Available Credit Limit

Remaining spending power - Minimum Payment Due

Lowest amount required to avoid penalties - Due Date

Payment deadline - Pending Transactions

Recent purchases not yet posted

Many users confuse available credit with zero debt – they’re not the same. Always review the outstanding balance + due date.

Recommended: FAB Balance Check

All Official Ways to Check Your FAB Credit Card Balance

FAB provides digital, SMS, ATM, and phone-based methods, so you can check anytime – online or offline.

Let’s walk through them from fastest to most practical.

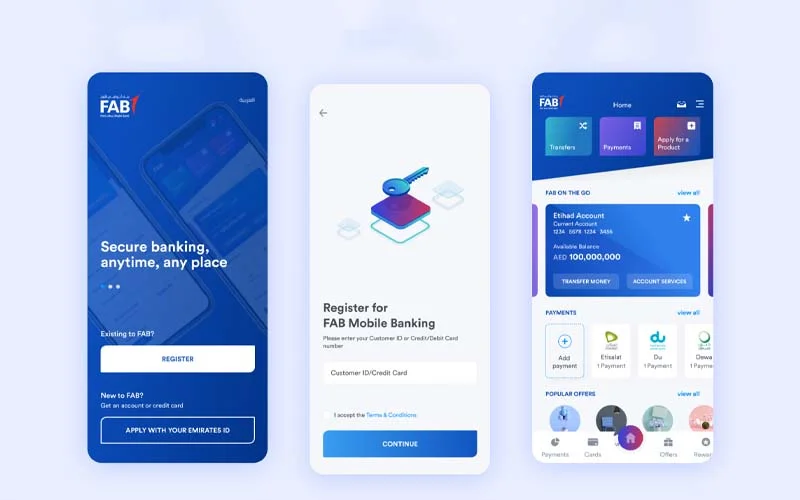

FAB Mobile App (Fastest & Recommended)

This is the primary method FAB encourages and the most reliable for real-time information.

Steps

- Download FAB Mobile Banking App (iOS / Android / Huawei)

- Log in using:

- Password

- Face ID / Fingerprint

- UAE Pass (where enabled)

- Tap Cards

- Select your credit card

You’ll instantly see:

- Outstanding balance

- Available limit

- Due date

- Recent transactions

Why this method is best

- Real-time updates

- Biometric login

- Secure

- Full transaction history

- Make payments instantly

Best for: daily tracking, bill payments, frequent users

FAB Online Banking (Desktop Access)

Ideal if you prefer managing finances on a laptop or need detailed statements.

Steps

- Visit official FAB website

- Select Personal Online Banking

- Log in with credentials

- Open Credit Cards section

You can:

- View balance

- Download statements

- Check minimum payment

- Monitor spending patterns

Best for: detailed review, downloads, business users

SMS Banking (Quick Check Without Internet)

Useful when:

- You have no data/Wi-Fi

- Traveling

- Using a basic phone

Format

Send from your registered mobile number:

CBAL <space> last 4 digits of your card

Example:

CBAL 1234

Send to: 2121

You’ll receive an automated reply with your balance.

Notes

- Works only with registered numbers

- May incur standard SMS charges

- Balance may not include very recent transactions

Best for: emergency or quick checks

ATM Balance Inquiry

You can check offline using any FAB ATM across the UAE.

Steps

- Insert card

- Enter PIN

- Select Balance Inquiry

- View or print receipt

Benefits

- No internet required

- Good for printed records

Best for: cash users or branch visitors

Phone Banking / Customer Care

For assistance or if you cannot access digital channels.

Official numbers

- Inside UAE: 600 52 5500

- International: +971 2 681 1511

- Saudi Arabia: 800 124 2222

You’ll verify identity via IVR or agent.

Best for: disputes, blocked accounts, special queries

Comparing All Methods

| Method | Speed | Internet Needed | Best Use |

|---|---|---|---|

| Mobile App | Instant | Yes | Daily monitoring |

| Online Banking | Fast | Yes | Statements & details |

| SMS | Quick | No | Basic check |

| ATM | Medium | No | Offline inquiry |

| Phone | Slow | No | Support issues |

Why Checking Your Balance Matters in the UAE: DBR Explained

Here’s where many cardholders miss a crucial point.

UAE banks don’t only look at your payment history – they calculate your Debt Burden Ratio (DBR).

What is DBR?

Debt Burden Ratio = % of your income used to pay debts

Formula

DBR (%) =

Total Monthly Debt Payments ÷ Monthly Income × 100

UAE Regulatory Norms

- Most borrowers: max 50%

- Pensioners/retirees: often 30–35%

Credit Cards Count Too

Banks usually include:

- Minimum payments OR

- Around 5% of your credit card limit/outstanding

So a high card balance directly increases DBR and can:

- Reduce loan eligibility

- Lower mortgage approval

- Limit new card approvals

Example

Monthly income: AED 20,000

Debts:

- Personal loan: 3,000

- Car loan: 2,000

- Credit card counted at 5% of 3,000 = 150

Total = 5,150

DBR = 25.75%

This is healthy and below regulatory limits.

Smart Tips for Managing Your FAB Credit Card Balance

Checking is only step one. Smart management saves money.

Practical habits

- Check balance weekly

- Pay more than minimum

- Enable transaction alerts

- Avoid maxing out limit

- Set autopay before due date

- Track DBR before applying for loans

Common mistakes

- Paying only minimums

- Ignoring pending transactions

- Forgetting annual fees

- Missing due dates while traveling

- Confusing limit with available balance

When Should You Check More Frequently?

You should monitor closely if:

- Applying for a mortgage or car loan

- Running a business with high expenses

- Traveling abroad

- Using installment plans

- Near credit limit

Security & Privacy Tips

Because banking fraud is rising across the region:

- Use only official FAB app/website

- Never share OTPs

- Avoid public Wi-Fi

- Enable biometric login

- Update contact details

FAB will never ask for passwords or PINs via SMS or calls.

Conclusion

Checking your FAB credit card balance is simple, but financially powerful.

The mobile app remains the fastest and most accurate method, while SMS and ATM options provide reliable backups.

More importantly, maintaining a controlled balance directly protects your Debt Burden Ratio, helping you qualify for future loans, mortgages, and business financing in the UAE.

A two-minute balance check today can save thousands in interest tomorrow.

Recommended Guide:

- ADCB Bank Balance Check

- Mashreq Bank Balance Check

- Check NBF Bank Balance

- Check Al Hilal Bank Balance

- Check CBD Bank Balance

- Check Ajman Bank Balance

- Check Citibank Bank Balance

- Check ADIB Bank Balance

- Check SIB Bank Balance

- Sharjah Islamic Bank

- Check RAKBANK Account Balance

- Fab balance check

FAQs

How do I check my FAB credit card balance instantly?

Use the FAB Mobile App → Cards section. It shows real-time balances.

Can I check my balance without internet?

Yes. Use SMS banking or any FAB ATM.

What number do I send SMS to?

Send CBAL + last 4 digits to 2121 from your registered mobile.

Does FAB charge for balance checks?

App and online are free. SMS may incur telecom charges.

Why is my available limit different from my balance?

Available limit shows remaining spending power, not what you owe.

How often should I check my balance?

At least weekly or after large purchases.

Does my credit card balance affect loan approval?

Yes. It impacts your Debt Burden Ratio (DBR), which banks use for eligibility.

Can I download statements online?

Yes. Through FAB Online Banking or the mobile app.

What if my balance looks incorrect?

Contact FAB customer support immediately.

Is the FAB app secure?

Yes. It uses biometric login, encryption, and OTP verification.

Shahzeen Usman is a full-time content writer based in the UAE, with over 5 years of local experience covering travel, lifestyle, and destination-focused stories. She specializes in creating engaging, research-driven content that highlights hidden gems, cultural insights, and travel trends across the Emirates and beyond.

With a deep understanding of UAE tourism, Shahzeen brings authentic perspectives to her writing, helping readers discover meaningful travel experiences. Her work combines storytelling with SEO best practices, making her content both informative and search-engine friendly.