How to Apply for a Personal Loan with a Salary of AED 2000? Complete UAE Guide (2026)

The UAE lending market has quietly shifted in favor of lower-income earners. After regulatory reforms removed the rigid minimum salary threshold that previously restricted access to consumer loans, approval decisions now rely more heavily on risk assessment, credit behavior, and employer credibility. For individuals earning AED 2000 per month, financing is no longer automatically out of reach – but it remains selective, conditional, and structured around strict affordability rules.

This guide explains how personal loans work at this income level, what lenders realistically offer, how regulations shape eligibility, and how to improve your chances of approval without risking financial stress.

Can You Get a Personal Loan with a AED 2000 Salary in the UAE?

Technically, yes – but not in the same way as someone earning AED 5000 or more.

Most traditional banks still prefer higher income thresholds for standard multi-year unsecured loans. However, smaller-ticket loans, micro-financing products, and revolving facilities have emerged to serve lower-income workers, particularly those paid through the Wage Protection System.

Approval is no longer based purely on income size. Instead, lenders focus on three core risk factors:

- Stability of employment

- Consistency of salary transfer

- Credit history and repayment behavior

If these are strong, a AED 2000 salary applicant may qualify for limited financing.

Recommended: Top 10 Best Credit Cards for Flight Miles

Regulatory Framework: What the Law Allows

Personal lending in the UAE is regulated by the Central Bank of the UAE. While the former mandatory minimum salary requirement was removed, key consumer protection rules still apply.

Maximum Loan Amount

Borrowers can receive up to 20 times their monthly salary.

For AED 2000 earners, this means a theoretical ceiling of AED 40,000.

In practice, lenders rarely approve the maximum for low-income applicants. Loan sizes are typically much smaller to control default risk.

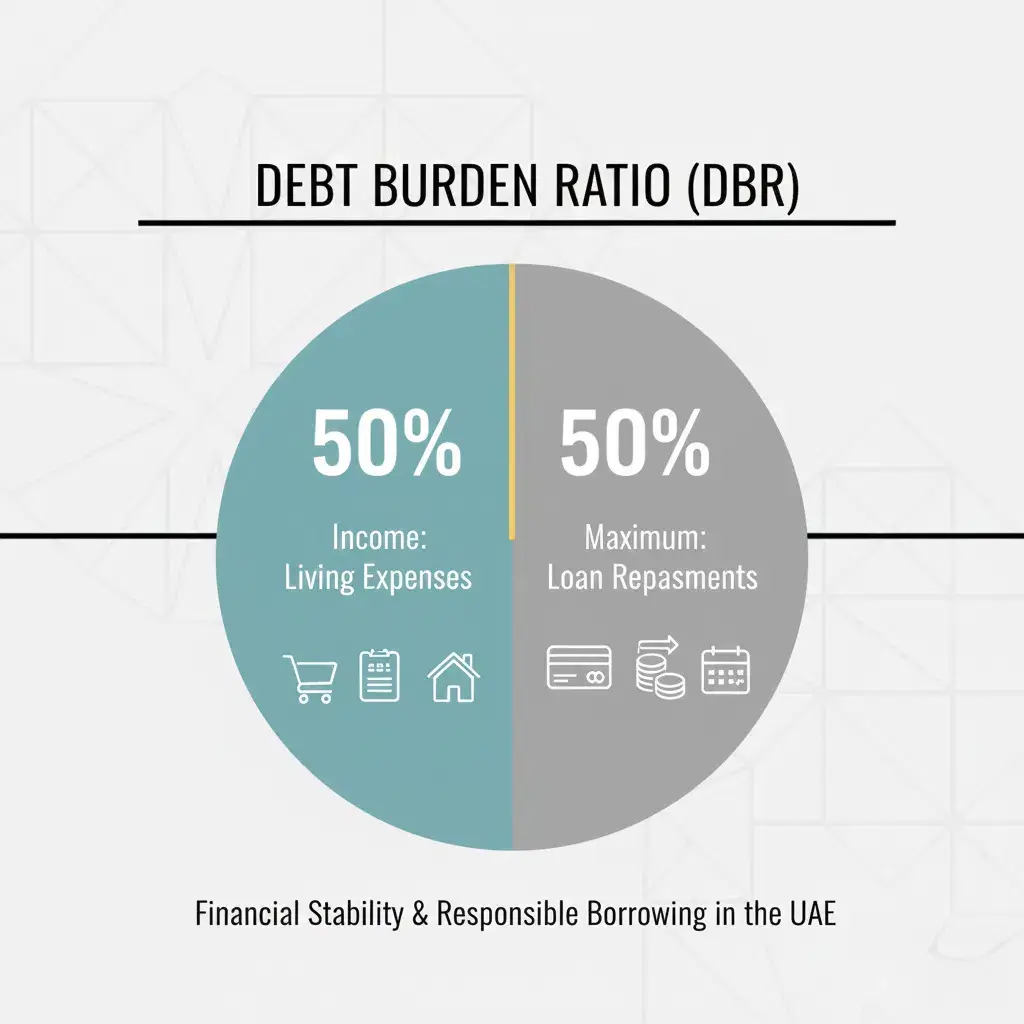

Debt Burden Ratio (DBR) Cap

Your total monthly repayments – including loans, credit cards, and other facilities – cannot exceed 50% of your income.

For AED 2000 salary: Maximum total monthly EMI = AED 1000

However, borrowing close to this limit is risky. A safer threshold is 30–35% of income.

Maximum Tenure

- Personal loans are capped at 48 months for expatriates.

- Shorter tenures are common for microloans.

Recommended: How to Get a Credit Card for 3500 Salary

Where Can You Apply with a AED 2000 Salary?

Mainstream banks remain cautious, but certain institutions and finance providers consider low-income applicants.

Dubai Islamic Bank – FlexiSalary

Dubai Islamic Bank has offered salary-linked products designed for accessibility. These are structured as smaller personal finance facilities tied to salary transfer and employer eligibility.

Approval depends heavily on employer listing and salary routing.

FAB Lifeline / Overdraft

First Abu Dhabi Bank provides revolving facilities for lower-income customers. Rather than a lump-sum loan, this functions like an overdraft linked to your account.

This option may suit emergency liquidity needs rather than long-term borrowing.

Finance Companies & NBFCs

Specialized finance companies often assess applications individually. Interest rates may be higher than major banks, but flexibility is greater for WPS-salaried workers.

Borrowers must compare processing fees, early settlement charges, and profit rates carefully.

Recommended: How to Get a Credit Card in UAE on AED 4,000 Salary

Essential Eligibility Requirements

Approval at AED 2000 depends less on income size and more on financial behavior.

Salary Transfer via WPS

Lenders strongly prefer salaries credited monthly through the Wage Protection System. Cash salaries significantly reduce approval chances.

Employer Status

Banks maintain internal “approved employer” lists. If your company has a strong payment record and an established relationship with lenders, your application becomes stronger.

Credit History

The Al Etihad Credit Bureau report is critical. Late telecom bills, BNPL defaults, or unpaid credit cards can result in automatic rejection.

Minimum Employment Duration

Most lenders require at least 3-6 months with your current employer.

Required Documents

Although documentation is straightforward, completeness matters at this salary level.

You typically need:

- Emirates ID

- Passport copy with residence visa

- Salary certificate addressed to the bank

- 3-6 months of bank statements

- Employment contract (in some cases)

Incomplete paperwork delays or weakens the application.

Recommended: Personal Loan in UAE with AED 3,000 Salary

What Interest Rates Should You Expect?

Interest rates for lower-income borrowers are usually higher because of perceived repayment risk.

Typical reducing rates may start above 10% and vary depending on:

- Credit score

- Employer category

- Salary bank relationship

- Existing liabilities

Flat rates advertised online should always be converted into reduced rates to understand the true cost.

Processing fees are usually capped at 1% of the loan amount, subject to regulatory limits.

Step-by-Step: How to Apply Successfully

Step 1: Check Your Financial Position

Before applying, calculate your current debt obligations. If your EMI ratio is already above 30%, reconsider borrowing.

Pull your credit report and ensure there are no unresolved defaults.

Step 2: Approach Your Salary Bank First

Your existing bank has visibility over your salary behavior. This increases approval probability compared to applying randomly.

Ask specifically about micro-financing or salary-linked facilities.

Step 3: Prepare a Clean 3-Month Record

Avoid:

- Bounced cheques

- Over-limit card usage

- Missed telecom payments

- BNPL late fees

Lenders review recent account activity carefully.

Step 4: Borrow Conservatively

Do not apply for the maximum amount allowed. Smaller loans with shorter tenures improve approval odds and reduce stress.

Risks of Borrowing at an AED 2000 Income

A AED 2000 salary leaves limited room for financial shock.

Even an AED 700 EMI consumes over one-third ofthe monthly income. Unexpected job loss, medical emergencies, or visa changes could quickly create repayment pressure.

Low-income borrowers should maintain at least one month of EMI as emergency savings before taking a loan.

Alternatives to Personal Loans for Low-Income Earners

If approval is difficult, consider safer options.

Employer Salary Advance

Many companies provide interest-free advances deducted over a few months.

Credit Card Installment Plans

Small purchases can sometimes be converted into short-term installment plans.

Payment Negotiation

If borrowing is to settle existing debt, negotiating a structured repayment directly with the creditor may reduce overall cost.

Economic Perspective: Why Approval Is Still Limited

Although regulations allow lending at lower salaries, operational costs and default risk remain key concerns for lenders.

Processing a AED 10,000 loan involves similar administrative costs as a AED 100,000 loan. As a result, many large banks prioritize mid-to-high income segments.

This is why specialized micro-lending and salary-linked products are becoming more common in the UAE market.

For a broader context, readers can explore related coverage on consumer lending reforms and banking policies in the UAE on emiratesbreaking.com’s finance section.

How to Improve Approval Chances

- Maintain consistent WPS salary credits

- Avoid multiple loan applications in short periods

- Reduce existing liabilities before applying

- Keep bank account activity stable

- Ensure employer documentation is accurate

Small behavioral improvements can significantly increase the probability of approval.

Conclusion

Getting a personal loan in the UAE with a AED 2000 salary is possible – but it requires strategic planning, financial discipline, and realistic expectations. Regulatory reforms have opened doors, yet lenders still evaluate affordability strictly through repayment capacity and credit history.

Applicants should prioritize stability over maximum borrowing and consider alternatives before committing to long-term debt. Responsible borrowing at this income level protects financial security and avoids long-term stress.

FAQs

Can I get a personal loan in UAE without salary transfer at AED 2000?

Approval is very unlikely. Most lenders require salary transfer through WPS to reduce repayment risk.

What is the maximum EMI allowed for AED 2000 salary?

Total monthly debt obligations cannot exceed 50% of income, meaning AED 1000. A safer level is below AED 700.

Which banks offer loans for AED 2000 salary?

Certain salary-linked or overdraft products may be available through banks such as Dubai Islamic Bank and First Abu Dhabi Bank, subject to eligibility and employer listing.

What documents are required?

You need Emirates ID, passport with visa, salary certificate, and recent bank statements. Some lenders may request an employment contract.

What are current interest rates for low-salary loans?

Rates are generally higher than mid-income loans and often start above 10%, reducing, depending on credit score and employer category.

How can I improve my approval chances?

Maintain clean banking records, avoid late payments, reduce existing debt, and apply through your salary bank first.

Are finance companies safer than informal lenders?

Yes. Always borrow from regulated institutions operating under UAE consumer lending regulations. Avoid unlicensed money lenders.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.