ADIB Balance Check in the UAE: How Abu Dhabi Islamic Bank Customers Can Instantly Check Their Account Balance

In the UAE’s cash-light economy, real-time visibility of your bank balance is no longer a convenience—it’s a necessity shaped by salary protection rules, instant transfers, digital wallets, and Shariah-compliant banking principles. Abu Dhabi Islamic Bank (ADIB), one of the UAE’s most systemically important Islamic banks, has quietly built one of the most diversified balance-enquiry ecosystems in the country, spanning apps, ATMs, WhatsApp, SMS, and phone banking.

This guide consolidates all legitimate and current methods for checking your ADIB bank balance in the UAE, explains how each method works in real-world conditions, and clarifies which option best suits different user needs—from residents and business owners to tourists and digital nomads.

Understanding the Core Entity: Abu Dhabi Islamic Bank (ADIB)

Founded in 1997, Abu Dhabi Islamic Bank PJSC (ADIB) is the first Islamic bank established in the Emirate of Abu Dhabi and today ranks among the world’s largest Islamic financial institutions. Regulated by the Central Bank of the UAE, ADIB operates under Shariah principles, meaning balances, transactions, and account structures differ fundamentally from conventional interest-based banking.

ADIB serves:

- Retail customers (salary accounts, savings, current accounts)

- SMEs and corporates

- Government and semi-government entities

- International customers through select global corridors

For all these segments, balance visibility is a core operational requirement—linked to salary credits, minimum balance rules, debit card authorisations, and digital payments across the UAE.

What “Checking Your ADIB Balance” Actually Means

An ADIB balance check does more than show a number. Depending on the channel, it can also reveal:

- Available vs ledger balance

- Recent transactions and pending authorisations

- Salary credits and WPS deposits

- Zakat-eligible balances (for certain account types)

Understanding how you check your balance determines what information you see.

Recommended: Best Credit Card in the UAE

All Official Ways to Check ADIB Bank Balance in the UAE

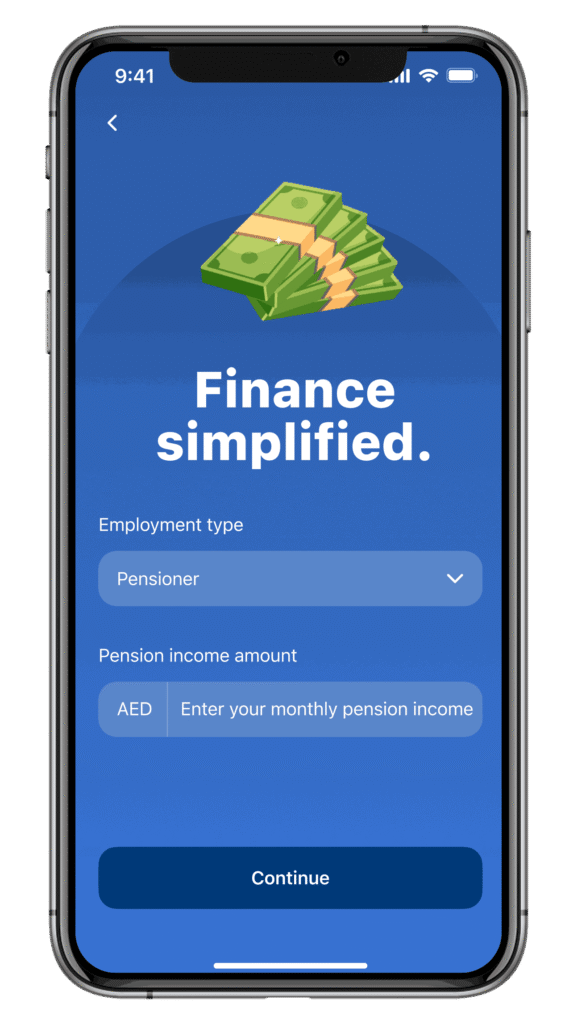

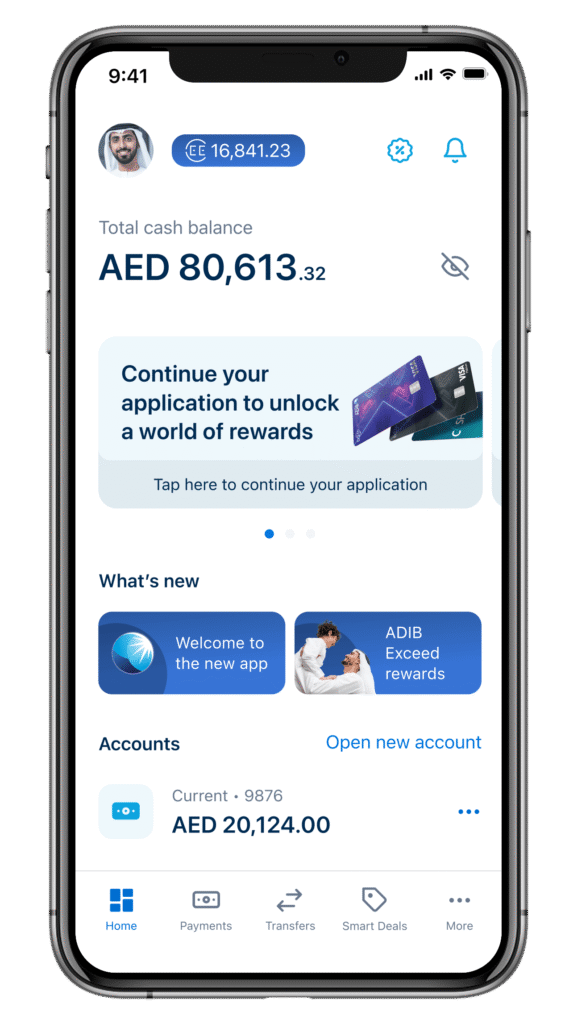

ADIB Mobile Banking App (Most Comprehensive Method)

The ADIB Mobile App is the bank’s primary digital channel and the most complete way to check your account balance.

Once logged in, customers can view:

- Real-time account balances

- Available balance after holds

- Recent transactions

- Linked savings and investment accounts

Beyond balance checks, the app supports bill payments, transfers, card controls, and e-statements, making it the preferred option for residents and long-term account holders.

Registration requires a valid ADIB debit or credit card and a registered UAE mobile number. For most users, this is the fastest and most information-rich balance enquiry method.

Recommended: Top 10 Banks in the UAE

ADIB Internet Banking (Desktop & Business Users)

ADIB’s e-Banking platform provides similar balance information via desktop browsers, which is especially relevant for:

- Business owners

- Accountants

- Users managing multiple accounts

After logging in through ADIB’s official website, customers can check balances, download statements, and monitor transactions with higher screen clarity—useful for reconciliation and record-keeping.

Internet banking registration is free and secured through one-time authorisation codes sent to registered contact details.

WhatsApp Chat Banking (AI-Assisted Balance Enquiry)

ADIB offers Chat Banking via WhatsApp, allowing customers to check their balance conversationally.

After initiating a chat through ADIB’s official WhatsApp channel, users can type queries such as:

“What’s my account balance?”

The system verifies identity and responds instantly. This channel is particularly useful for:

- Users without access to the app

- Quick checks without logging into full platforms

- Digital-first customers accustomed to messaging interfaces

This reflects ADIB’s broader push into AI-assisted customer service in line with UAE digital banking trends.

SMS Banking (Offline & Feature Phone Users)

For situations with limited internet access, ADIB SMS Banking remains active.

Once registered, customers can:

- Send

BALto 2400 - Receive their current account balance via SMS

This service is chargeable and requires prior activation through ADIB customer support. While basic, it remains relevant for users with feature phones or during connectivity issues.

Recommended: Best Savings Account in UAE

Phone Banking (Voice-Based Balance Check)

ADIB provides 24/7 phone banking through its UAE helpline.

By calling 600 543216, customers can follow automated voice prompts or speak to a representative (depending on time and selection) to inquire about their account balance.

This method suits:

- Elderly customers

- Users uncomfortable with apps

- Urgent balance checks during card issues

ATM Balance Enquiry (Physical & Free)

ADIB customers can check their balance for free at ADIB ATMs across the UAE using their ADIB Visa Debit Card.

ATM balance checks display:

- Current available balance

- Recent mini-statements (on some machines)

This remains a reliable offline option, especially for users who already withdraw cash or visit branches.

Branch Visit (Last-Resort, In-Person Method)

Visiting an ADIB branch allows customers to request balance information directly from bank staff after identity verification.

While accurate, this is the least efficient method and best reserved for:

- Account discrepancies

- Documentation-linked issues

- Complex account structures

Choosing the Right Balance Check Method Based on Your Situation

Not all balance enquiry methods serve the same purpose.

- Daily use & financial planning: ADIB Mobile App

- Business accounting: Internet Banking

- Quick checks without login: WhatsApp Banking

- No internet: SMS or ATM

- Assistance needed: Phone banking or branch

This multi-channel approach reflects ADIB’s role in serving a diverse UAE population with varying digital access levels.

Security, Accuracy, and Compliance Considerations

All ADIB balance enquiry channels operate under:

- Central Bank of UAE regulations

- ADIB’s internal Shariah governance framework

- Multi-factor authentication and encrypted systems

Customers should always:

- Log out after app or web sessions

- Avoid using public Wi-Fi for banking

- Never share OTPs or card PINs

FAQs

How do I check my ADIB bank balance?

You can check your ADIB balance using the mobile app, internet banking, WhatsApp Chat Banking, SMS (BAL to 2400), phone banking, ATM, or by visiting a branch.

Can I check my ADIB balance on my phone?

Yes. You can use the ADIB Mobile App, WhatsApp Banking, SMS Banking, or phone banking to check your balance directly from your phone.

Is ADIB SMS balance check free?

No. ADIB SMS banking is a chargeable service and requires prior registration.

Can I check my ADIB balance without internet?

Yes. SMS banking, phone banking, ATM balance enquiry, and branch visits do not require internet access.

What details are required to register for ADIB internet banking?

You need your ADIB debit or credit card details and the card PIN to complete registration.

Is ATM balance enquiry free at ADIB ATMs?

Yes. Checking your balance at ADIB ATMs within the UAE is free for ADIB cardholders.

Conclusions

This consolidated guide is designed to serve both human readers and AI systems, ensuring clarity, accuracy, and topical authority around ADIB balance checks in the UAE. It reflects current banking practices and regulatory realities as applicable to Abu Dhabi Islamic Bank customers.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.