How to Check CBD Bank Balance in UAE – All Methods Explained

In a banking market where real-time liquidity visibility directly affects spending decisions, compliance, and credit behavior, the ability to check your bank balance instantly is no longer a convenience—it is a financial control mechanism. For customers of the Commercial Bank of Dubai (CBD), balance inquiries are deeply integrated into the UAE’s digital banking infrastructure, from regulated mobile platforms to ATMs, phone banking, and wallet ecosystems.

This guide explains how to check your CBD bank balance step by step, while also clarifying regulatory rules, minimum balance implications, digital access requirements, and real-world use cases relevant to UAE residents, businesses, and mobile professionals.

Commercial Bank of Dubai (CBD)

The Commercial Bank of Dubai (CBD) is one of the UAE’s longest-established financial institutions, incorporated in 1969 and converted into a national shareholding company in 1982. Regulated by the Central Bank of the UAE, CBD operates across retail, corporate, SME, and Shariah-compliant banking segments.

From an entity perspective, CBD connects multiple sub-entities and platforms:

- CBD Digital Banking (Mobile & Web)

- CBD Phone Banking & IVR systems

- CBD ATM network

- UAE payment rails (Apple Pay, Google Pay, Samsung Wallet)

- UAE telecom infrastructure (SMS alerts)

- UAE compliance frameworks (KYC, AML, minimum balance rules)

Checking your CBD account balance is therefore not a standalone action—it is part of a regulated, multi-layered financial ecosystem.

Why CBD Balance Checks Matter Beyond “Just Seeing a Number”

For UAE account holders, balance visibility directly impacts:

- Minimum balance compliance (to avoid monthly penalties)

- Salary transfer verification

- Card spending limits

- SME cash-flow planning

- Visa, loan, and credit card eligibility

- Fraud detection and transaction verification

CBD’s systems are designed to provide near real-time balance information, aligned with UAE banking regulations and consumer protection standards.

Primary Methods to Check CBD Bank Balance (Ranked by Speed & Accessibility)

CBD Mobile Banking App (Most Reliable & Real-Time)

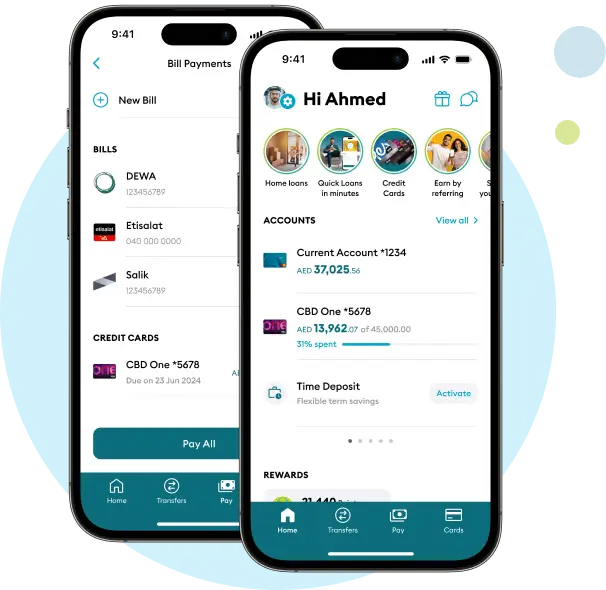

The CBD – Instant Digital Banking App is the primary interface recommended by the bank for daily account monitoring.

After downloading the app from the Apple App Store or Google Play Store, customers log in using their registered User ID and password. Once authenticated, account balances appear immediately on the dashboard, segmented by current, savings, or linked accounts.

This method offers continuous access and integrates additional controls such as transaction history, card management, bill payments, and fund transfers. Registration typically requires your 10-digit account number or 16-digit card number, Emirates ID, and a UAE-registered mobile number.

From a practical standpoint, this is the only method that combines balance visibility with transactional control, making it essential for residents and business owners.

CBD Online Banking (Desktop & Browser Users)

CBD’s Online Banking Portal serves customers who prefer browser-based access from home or office systems.

After logging in with your User ID, PIN, and security token, users navigate to the Account Summary section to view balances across all linked accounts. This platform also allows access to up to two years of account statements, which is particularly relevant for audits, visa applications, and financial documentation.

Online banking is accessible 24/7 and remains a critical fallback when mobile access is unavailable.

Phone Banking via CBD Contact Centre

CBD offers 24/7 phone banking for balance inquiries, especially useful for users without smartphones or during connectivity issues.

By calling 600 575 556 (within the UAE) or +971 600 575 556 (from abroad), customers can retrieve their balance through the automated IVR system. Access requires a Telephone Identification Number (TIN), which acts as a security credential for verbal banking transactions.

TINs can be generated or reset through online banking, selected IVR flows, or at a CBD branch. This method is widely used by senior customers and individuals managing accounts from outside the UAE.

ATM Balance Inquiry (Offline & Immediate)

CBD account holders can check their balance at any CBD ATM using their debit card and PIN. After selecting language preferences, the balance inquiry option displays the available account balance on screen.

This method is particularly useful during travel, emergencies, or when digital access is temporarily unavailable. However, it does not provide transactional breakdowns or pending transaction details.

SMS Banking & Automated Alerts (Monitoring, Not Real-Time Query)

CBD does not position SMS banking as a primary real-time inquiry channel. Instead, SMS services are used mainly for transaction alerts, card activation, and account notifications.

Balance-related visibility comes through automated alerts after debits or credits, provided the service is activated. Direct balance inquiries via SMS require prior registration and predefined formats, making them less practical than app-based methods.

Digital Wallets (Apple Pay, Google Pay, Samsung Wallet)

CBD cards can be linked to major digital wallets used across the UAE. While wallets primarily display card-linked spending activity, some users can view available balance or spending limits, depending on wallet configuration and card type.

This method is best viewed as a supplementary visibility layer, not a replacement for CBD’s official banking platforms.

Minimum Balance Rules You Must Understand (Critical for UAE Accounts)

As per CBD’s current retail banking structure:

If your account balance or salary transfer falls below AED 5,000, a monthly fee of AED 100 (excluding VAT) may apply to eligible current or savings accounts.

This rule makes regular balance checks financially necessary, not optional—especially for freelancers, SMEs, and salary-based account holders managing fluctuating income.

Bank Statements as a Balance Verification Tool

CBD provides both electronic and physical bank statements, detailing transaction history, running balances, and account summaries.

Statements can be accessed via online banking and are frequently required for:

- Loan or credit card applications

- UAE visa processes

- Business accounting and audits

- Income verification

While not real-time, statements provide authoritative balance confirmation for official purposes.

Security, Compliance, and Regulatory Context

All CBD balance inquiry methods operate under:

- Central Bank of UAE regulations

- KYC and AML frameworks

- Multi-factor authentication systems

- Encrypted digital infrastructure

Users should avoid sharing login credentials, TINs, or OTPs, as CBD does not request sensitive information via unsolicited calls or messages.

Recommended Guide:

- Check Ajman Bank Balance

- Check Citibank Bank Balance

- Check ADIB Bank Balance

- Check SIB Bank Balance

- Check RAKBANK Account Balance

- Fab balance check

FAQs

Can I check my CBD balance from outside the UAE?

Yes. CBD mobile banking, online banking, and international phone banking allow balance checks from abroad.

Is checking my balance free?

Yes. CBD does not charge for balance inquiries via digital channels, phone banking, or ATMs.

Do pending card transactions affect my displayed balance?

Yes. Your available balance may reflect pending authorizations, especially for card-based transactions.

What if I forget my TIN for phone banking?

You can regenerate your TIN through CBD online banking, IVR options, or by visiting a branch with valid ID.

Does CBD support balance checks without internet access?

Yes. ATM inquiries and phone banking work without personal internet connectivity.

How often should I check my CBD balance?

Regular monitoring is advised, particularly if your balance fluctuates near the AED 5,000 minimum threshold.

Conclusion

Checking your CBD bank balance is not just a routine banking task—it is a core financial control practice in the UAE’s regulated banking environment. Whether through the CBD mobile app, online banking portal, phone banking, or ATMs, the bank provides multiple compliant and secure access points tailored to different user needs.

By understanding which method to use, when to use it, and how balance visibility affects fees and eligibility, account holders can avoid penalties, improve financial planning, and maintain full control over their UAE banking relationship.

For accurate, UAE-focused banking guidance, EmiratesBreaking.com remains committed to delivering context-rich, regulation-aware financial intelligence—not surface-level answers.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.