Check Citibank Bank Balance UAE – App, Online Login, ATM & Phone

Citibank has been steadily reducing its physical retail footprint in several markets, including the UAE, while doubling down on digital-first banking, remote servicing, and global account access. This shift has made knowing how to check your Citibank bank balance accurately and securely more important than ever—especially for UAE residents, international professionals, and globally mobile customers who rely on Citi’s cross-border capabilities.

This guide consolidates every official, reliable, and currently supported method to check your Citibank account balance in the UAE, while also explaining important differences between global Citi services and legacy country-specific features that often confuse online.

Understanding Citibank: Check Citibank Bank Balance

Citibank operates in the UAE primarily as a corporate, institutional, and wealth-focused bank, regulated by the Central Bank of the UAE (CBUAE). While Citi has exited mass retail banking in several regions, many UAE residents still hold:

- Legacy Citibank personal accounts

- International Citi accounts opened abroad but accessed from the UAE

- Citi credit cards or wealth management relationships

Because of this structure, balance enquiry methods in the UAE are digital-first, with limited branch-based retail services compared to local banks like FAB or ENBD.

Primary Ways to Check Citibank Bank Balance in the UAE

Citibank Online Banking (Desktop & Browser Access)

The most reliable and comprehensive way to check your Citibank account balance in the UAE is through Citi Online Banking.

After signing in via Citi’s official login portal, users are directed to an account overview dashboard that displays their current balance, available balance, recent transactions, and linked products. This method is especially useful for business owners, investors, and customers managing multiple accounts across regions.

Online banking provides the most accurate real-time view of your balance and reflects pending transactions faster than statements or SMS alerts.

Best for: Detailed balance checks, international accounts, business users, and secure desktop access.

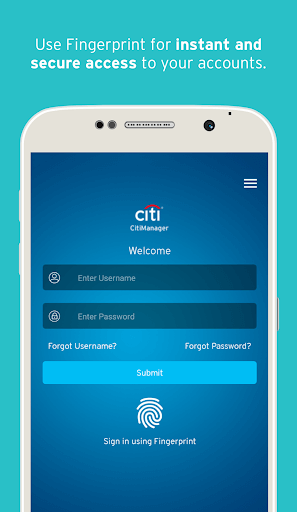

Citi Mobile® App (Recommended for Daily Use)

For most users in the UAE, the Citi Mobile App is the fastest and most practical option.

Once logged in, your bank balance is displayed immediately on the dashboard. The app supports biometric authentication (Face ID or fingerprint), reducing the need for repeated passwords. Citi’s “Mobile Snapshot” feature also allows limited balance visibility without full login, which is helpful for quick checks while traveling.

Because Citi operates globally, the mobile app automatically adapts to your account’s home country while remaining accessible from the UAE.

Best for: UAE residents, digital nomads, frequent travelers, and everyday balance checks.

ATM Balance Inquiry (Limited but Still Available)

If you hold a Citibank debit card linked to an active account, you can check your balance at Citibank ATMs. In the UAE, Citibank-branded ATMs are limited, and third-party ATMs may not always support balance inquiry for international cards.

When available, the process is straightforward: insert your card, enter your PIN, and select “Balance Inquiry” or “Account Summary.” Some ATMs allow receipt printing, while others only display the balance on screen.

Important: Third-party ATM networks may charge a fee, and balance visibility can sometimes lag behind real-time updates.

Recommended: Citibank Citi Simplicity Card

Phone Banking (UAE-Specific Support)

Citibank provides phone banking support for UAE-based customers via its regional contact center. After identity verification, automated systems or customer service agents can confirm your current balance and recent transactions.

Phone banking is particularly useful if you are locked out of online access or need balance confirmation while resolving an account issue.

Note: Always call the official UAE Citibank number listed on Citi’s website or the back of your card to avoid fraud.

SMS Banking (Availability Varies)

SMS banking for Citibank is not universally available in the UAE and depends on the country where your account was originally opened. Many online guides reference SMS formats from India or the US, which may not apply to UAE-based or international accounts.

If your account supports SMS alerts, balance notifications are usually sent automatically rather than on-demand via text commands. UAE users should confirm SMS functionality through Citi Online or customer support.

Monthly Statements and E-Statements

Citibank issues monthly bank statements that clearly show opening balance, transactions, and closing balance. UAE customers typically receive these as secure e-statements, accessible through online banking.

While statements are not real-time, they remain essential for auditing, tax reporting, business accounting, and financial planning—especially for investors and entrepreneurs.

Important Balance Types You Should Understand

Many balance-related misunderstandings come from not knowing which balance is being displayed:

- Current Balance: Reflects posted transactions only

- Available Balance: Adjusts for pending debits and holds

- Statement Balance: Snapshot at the end of a billing cycle

For UAE users managing rent payments, investments, or international transfers, the available balance is the most practical figure to monitor.

Security and Compliance Considerations

Citibank adheres to global compliance standards, in addition to UAE banking regulations. To protect your balance information:

- Avoid public Wi-Fi when accessing Citi Online or the mobile app

- Enable two-factor authentication

- Never share OTPs or login credentials

- Use only official Citi apps and websites

These practices align with CBUAE cybersecurity guidance and help prevent unauthorized access.

Common Mistakes to Avoid When Checking Citibank Balance

A recurring issue across many low-quality guides is mixing country-specific Citibank services. Features like missed-call banking, passbooks, or certain SMS commands apply to India-only retail banking and are not supported in the UAE.

EmiratesBreaking.com recommends verifying every balance-check method against your account’s country of origin, not just your current location.

Recommended Guide:

FAQs

How do I check my Citibank bank balance in the UAE?

You can check your balance using the Citi Mobile App, Citi Online Banking, phone banking, or eligible ATMs. Digital methods are the most reliable in the UAE.

Can I check my Citibank balance by SMS in the UAE?

SMS banking availability depends on where your account was opened. Many UAE users only receive automated alerts rather than on-demand balance texts.

Is Citi Mobile App accessible from the UAE?

Yes. The app works globally and adapts to your account’s home country while remaining fully accessible from the UAE.

Are Citibank branches available for balance checks in the UAE?

Citibank has limited retail branches in the UAE. Most balance inquiries are handled digitally or via phone banking.

Is it safe to check my Citibank balance online?

Yes. Citibank uses advanced encryption, biometric login, and multi-factor authentication, aligning with international and UAE security standards.

Conclusion

Checking your Citibank bank balance in the UAE is no longer about visiting branches—it’s about understanding Citi’s digital-first, globally connected banking model. By using the Citi Mobile App or Online Banking, customers gain real-time visibility, stronger security, and seamless access across borders.

For UAE residents, professionals, and investors managing international finances, mastering these balance-check methods is essential for smarter money management in 2026 and beyond. EmiratesBreaking.com will continue to provide accurate, region-aware banking guides that reflect how global banks actually operate in the UAE—not how outdated articles assume they do.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.