How to Check RAKBANK Account Balance in the UAE: A Complete, Official Guide

In the UAE’s increasingly digital-first banking ecosystem, real-time account visibility is no longer a convenience—it’s a regulatory and financial necessity. RAKBANK (National Bank of Ras Al Khaimah), one of the country’s most established retail and business banks, has steadily expanded its balance inquiry infrastructure to serve residents, SMEs, and mobile professionals who expect instant access without compromising security.

This guide explains every verified method for checking your RAKBANK account balance in the UAE, clarifies when each method is most suitable, and highlights practical considerations that are often overlooked in surface-level explanations.

Understanding the Core Entity: RAKBANK and Account Balance Access

Founded in 1976, RAKBANK operates under the supervision of the Central Bank of the UAE and serves retail customers, SMEs, and corporate clients through 21 branches, a nationwide ATM network, and multiple digital platforms.

Checking a RAKBANK account balance is not a single action—it is an interaction between the customer, the banking channel, the account type, and the authentication layer. The available balance you see may differ depending on pending transactions, card authorisations, or linked facilities such as overdrafts and credit cards.

Digital-First Balance Check Methods (Recommended)

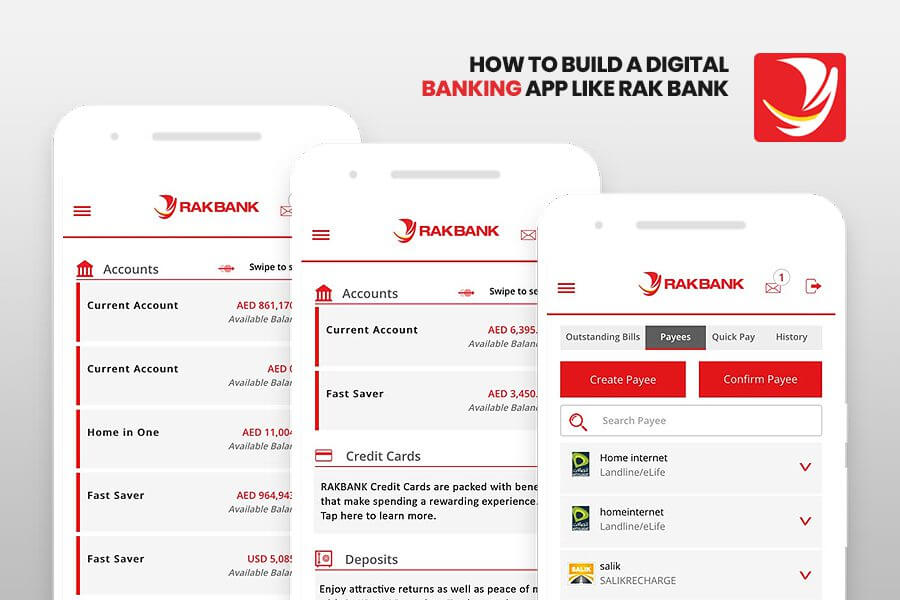

RAKBANK Mobile App (Personal & Business Accounts)

For most customers, the RAKBANK Mobile App is the fastest and most reliable way to check balances in real time.

After registering with your account or card number and completing OTP verification, the app allows you to view:

- Savings and current account balances

- Debit and credit card outstanding amounts

- Recent transactions and pending authorizations

- Multi-currency account balances (where applicable)

A notable feature is Quick Balance Inquiry (QBI), available on supported devices. Once enabled in app settings, it allows balance checks using Face ID or fingerprint authentication without a full login, which is particularly useful for frequent checks during travel or business hours.

From a security standpoint, the app complies with UAE banking authentication standards, including biometric protection and transaction alerts.

RAKBANK Online Banking (Digital Banking Portal)

RAKBANK’s web-based Digital Banking Portal offers full account visibility for customers who prefer desktop access or require deeper transaction analysis.

After logging in through the official RAKBANK website, users can:

- View real-time balances across all linked accounts

- Access transaction histories and downloadable e-statements

- Monitor card balances and payment due dates

- Review business account activity with higher transaction limits

This channel is particularly useful for business owners, accountants, and investors who need documentation or historical data rather than quick balance snapshots.

Assisted and Offline Balance Check Options

Phone Banking – RAKdirect

RAKBANK operates a 24/7 phone banking service known as RAKdirect, designed for customers who need human or IVR-assisted access.

You can check your balance by calling:

- 600 54 4049 (within the UAE)

- 04 213 0000 (alternative contact centre number)

Once authenticated using your registered mobile number and security details, the IVR or customer service agent can confirm:

- Available account balance

- Credit card outstanding amount

- Minimum payment and due dates

This method remains relevant for customers without stable internet access or during app outages.

ATM Balance Enquiry

RAKBANK ATMs across the UAE allow 24/7 balance checks using your debit card and PIN. The balance can be viewed on-screen and, if required, printed as a mini-statement.

While ATMs are reliable, they reflect balances after posting, meaning very recent digital transactions may not always appear instantly.

Branch Visit (Verification & Official Documentation)

Visiting a RAKBANK branch is generally unnecessary for routine balance checks, but it becomes relevant when you require:

- An official balance confirmation letter

- Signed or stamped statements for visa, loan, or audit purposes

Some branch-issued documents may carry nominal service fees, depending on account type and request urgency.

Email-Based Balance Confirmation (Exceptional Use)

RAKBANK allows customers to request a Balance Confirmation Letter via email by submitting the official form from their registered email address to eservice@rakbank.ae.

This method is not intended for daily balance checks and is typically used when:

- Digital banking access is temporarily unavailable

- Formal documentation is required for third-party verification

Understanding Different RAKBANK Balance Types

Not all balances represent the same financial position. RAKBANK customers typically interact with four balance categories:

Savings account balances reflect deposited funds that may earn interest but can be subject to withdrawal conditions.

Current account balances are designed for frequent transactions and business activity, usually without interest accrual.

Debit card balances mirror available funds linked directly to your account, including temporary card holds.

Credit card balances represent outstanding liabilities, not available cash, and accrue interest if unpaid beyond the billing cycle.

Understanding these distinctions prevents misinterpretation—particularly for SMEs and salary account holders managing auto-debits.

Fees, Costs, and Regulatory Transparency

RAKBANK does not charge for balance checks conducted via:

- Mobile app

- Online banking

- Phone banking IVR

- ATMs

Charges may apply only for physical documentation or special confirmation letters, in line with UAE banking disclosure norms.

Security and Compliance Considerations in the UAE

RAKBANK follows the Central Bank of the UAE cybersecurity and consumer protection guidelines. Customers should note:

- The bank never requests PINs, OTPs, or passwords via calls or messages

- Official platforms use encrypted connections and registered communication channels

- Suspicious activity should be reported immediately through RAKdirect or branch support

Regular balance monitoring is not just good practice—it is a key fraud-prevention measure under UAE consumer banking frameworks.

When and Why You Should Check Your RAKBANK Balance Regularly

Frequent balance checks help:

- Avoid failed salary-linked auto-debits

- Detect unauthorized transactions early

- Manage SME cash flow more accurately

- Maintain minimum balance requirements where applicable

For salary account holders and business owners, weekly monitoring is considered a prudent baseline.

Related Reading on EmiratesBreaking.com

For deeper financial clarity, readers may also find value in:

These guides provide broader regulatory and financial context around everyday banking actions.

FAQs

How can I check my RAKBANK account balance instantly?

The fastest method is the RAKBANK Mobile App using Quick Balance Inquiry with biometric authentication.

Can I check my RAKBANK balance online without visiting a branch?

Yes. Online banking and the mobile app provide 24/7 real-time balance access.

Is there an SMS or USSD balance check option?

RAKBANK previously supported limited USSD services, but customers are advised to use the app, online banking, or phone banking for accurate, up-to-date balances.

What number do I call to check my RAKBANK balance?

You can call 600 54 4049 within the UAE or 04 213 0000 to reach RAKdirect.

Does checking my balance cost money?

No. Digital, phone, and ATM balance checks are free. Fees may apply only for official printed confirmations.

Is my credit card balance the same as my account balance?

No. Credit card balances represent amounts owed, while account balances reflect available funds.

Conclusion

This guide reflects verified RAKBANK channels and UAE banking practices. Customers should always rely on official RAKBANK platforms for real-time financial decisions.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.