Current Account in UAE (2026): Rules, Banks, Requirements, and Best Options Explained

In 2025, current accounts in the UAE have become the backbone of daily financial activity, not just for businesses but also for salaried residents, freelancers, and digital-first users. As banks accelerate digital onboarding and regulators tighten compliance, the modern current account now sits at the intersection of payments, salary transfers, cheques, overdrafts, and multi-currency access—features that savings accounts in the UAE typically do not offer.

This guide explains what a current account in the UAE is, who it’s for, how it works, and which banks offer the most practical options, based on real regulatory requirements and market practices.

What Is a Current Account in the UAE?

A current account (also called a checking account) is a transactional bank account designed for frequent inflows and outflows of money. In the UAE, current accounts are regulated by the Central Bank of the UAE (CBUAE) and are widely used for:

- Salary transfers

- Business and professional income

- Cheque-based payments

- Daily expenses and bill payments

- Local and international fund transfers

Unlike savings accounts, current accounts typically do not pay interest, but they offer operational flexibility that savings accounts often restrict.

Recommended: Saving Accounts

Why Current Accounts Matter in the UAE Financial System

Current accounts play a structural role in the UAE economy because:

- Salaries are typically paid only into current accounts

- Cheques remain legally and commercially significant

- Many government and corporate payments require a current account

- Overdraft facilities are only available on current accounts

- Businesses cannot operate legally without them

For residents, entrepreneurs, and investors, a current account is not optional—it is financial infrastructure.

Key Features of Current Accounts in the UAE (2026)

Most UAE current accounts share the following core attributes:

Transactional Capabilities

- Unlimited or high daily transaction limits

- Local and international transfers (SWIFT, IBAN-based)

- Salary credits and employer integrations

Payment Instruments

- Debit card (Visa or Mastercard)

- Chequebook (AED accounts)

- Digital wallets and contactless payments

Account Facilities

- Overdraft (subject to approval)

- Standing instructions and direct debits

- Multi-currency holding (bank-dependent)

Digital Access

- Mobile banking apps

- Online banking portals

- UAE Pass–enabled onboarding

Current Account vs Savings Account in the UAE

| Feature | Current Account | Savings Account |

|---|---|---|

| Purpose | Daily transactions | Saving money |

| Interest | Usually none | Yes (limited) |

| Chequebook | Yes | No |

| Salary transfer | Yes | No |

| Overdraft | Available | Not allowed |

| Transaction limits | High | Restricted |

For most residents, both accounts serve different roles, but daily financial life in the UAE runs through a current account.

Who Can Open a Current Account in the UAE?

Eligibility Criteria (Standard Across Banks)

To open a personal current account, you generally need:

- Residency: UAE national or valid UAE residence visa

- Age: Minimum 18–21 years (varies by bank)

- Employment or income source

Required Documents

Most banks require:

- Original passport + copy

- Valid Emirates ID

- UAE residence visa (for expatriates)

- Proof of address (tenancy contract or utility bill)

- Salary certificate or salary transfer letter

For self-employed individuals or business owners, additional documents may include:

- Trade licence

- Company incorporation documents

- Proof of business activity

Types of Current Accounts Available in the UAE

1. Regular Personal Current Accounts

Standard accounts for salaried individuals and residents, usually with a minimum salary or balance requirement.

2. Zero-Balance / Digital Current Accounts

Mobile-first accounts with no minimum balance, often linked to a salary transfer threshold.

3. Islamic (Shariah-Compliant) Current Accounts

Structured under Islamic banking principles, avoiding interest and using fee-based models.

4. Premium & Elite Current Accounts

Designed for high-net-worth individuals with:

- Higher balance requirements

- Dedicated relationship managers

- Lifestyle and travel privileges

Minimum Salary & Balance Requirements (2025 Snapshot)

Most UAE banks waive monthly fees if you meet one of two conditions:

- Maintain a minimum average balance

- Transfer a minimum monthly salary

Examples from Major UAE Banks

| Bank | Requirement | Key Highlights |

|---|---|---|

| Emirates NBD | AED 5,000 salary OR AED 3,000 balance | Large ATM network, fast international transfers |

| ADCB | AED 5,000 salary | Digital onboarding, free chequebook |

| Mashreq Neo | AED 5,000 salary | Zero-balance, fully digital |

| FAB | AED 3,000 initial deposit | Multi-currency, reward programs |

| HSBC UAE | AED 5,000 salary (Premier higher) | Global banking access |

Zero-Balance Current Account Options in the UAE

Several banks now offer zero minimum balance current accounts, especially through digital platforms:

- Mashreq NEO – App-based onboarding, salary-linked

- Al Hilal Bank – Shariah-compliant, multi-currency

- SIB Digital Account – Zero-balance Islamic option

- FAB One Account – No balance requirement with benefits

These accounts are popular among young professionals, freelancers, and digital nomads.

Best Current Accounts in UAE

Rather than one “best” account, suitability depends on use case:

- Salaried employees → Emirates NBD, ADCB, Mashreq

- Zero-balance seekers → Mashreq Neo, Al Hilal, FAB One

- High-income professionals → HSBC Premier, FAB Elite

- Islamic banking users → ADIB, Al Hilal, SIB

(For detailed bank-by-bank analysis, see related explainers on EmiratesBreaking.com.)

How to Open a Current Account in the UAE

Online / Mobile Application

Most major banks allow instant or near-instant opening via:

- Bank mobile apps

- Emirates ID scanning

- UAE Pass authentication

This is now the fastest and most common method.

In-Branch Application

Still preferred for:

- Joint accounts

- Premium banking

- Complex income structures

Bring original documents for verification.

Fees, Charges, and Penalties to Watch For

When choosing a current account, pay close attention to:

- Minimum balance penalty (monthly)

- ATM withdrawal fees (other banks)

- International transfer charges

- Chequebook replacement fees

- Overdraft interest rates

Failure to meet balance or salary conditions can result in monthly maintenance fees.

How to Choose the Right Current Account in the UAE

Ask these questions before applying:

- Do I meet the salary or balance requirement?

- Do I need cheques or overdraft access?

- Will I transact internationally or in multiple currencies?

- Is digital banking sufficient, or do I need branch access?

- Is Shariah compliance important to me?

The “best” account is the one that minimises friction and fees for your actual usage.

Regulatory & Institutional Context

Current accounts in the UAE operate under:

- Central Bank of the UAE (CBUAE) regulations

- UAE Anti-Money Laundering (AML) laws

- Know Your Customer (KYC) compliance

- Salary transfer systems (WPS for certain employers)

Banks are legally required to verify identity, income source, and residency status.

Frequently Asked Questions (FAQ)

What is a current account in the UAE?

A current account is a transactional bank account used for daily payments, salary transfers, cheques, and frequent fund movements.

Who is eligible to open a current account in the UAE?

UAE nationals and residents aged 18 or above who meet bank-specific salary or balance requirements.

Can tourists open a current account in the UAE?

Generally no. Most banks require UAE residency. Tourists may only qualify for limited non-resident accounts.

What is the minimum balance for a current account in the UAE?

It varies by bank. Some require AED 3,000–5,000, while digital or salary-linked accounts may offer zero-balance options.

Which bank is best for a current account in the UAE?

There is no single best bank. Emirates NBD, FAB, ADCB, Mashreq, and HSBC each serve different user needs.

Can I have more than one current account?

Yes. UAE law does not limit the number of current accounts an individual can hold.

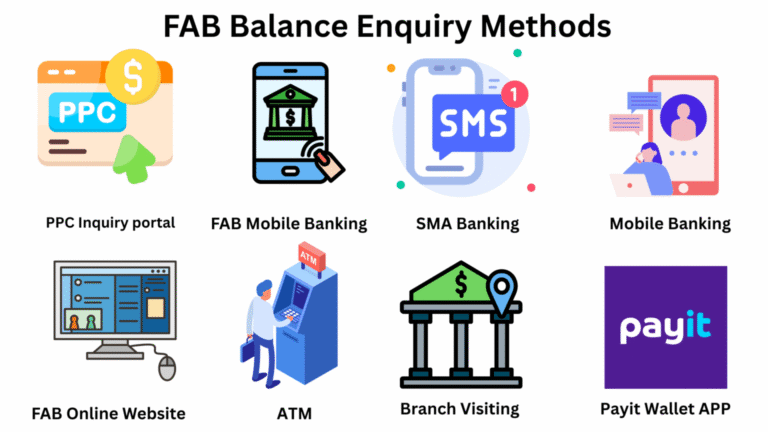

How can I access funds in my current account?

Through debit cards, online banking, mobile apps, cheques, ATMs, and branch services.

Editorial Note

This guide is designed to provide entity-complete, regulation-aware, and practical coverage of current accounts in the UAE, aligned with EmiratesBreaking.com’s mission to deliver clear, authoritative financial intelligence for residents, businesses, and global readers.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.