FAB Balance Check in the UAE: How to Check Your First Abu Dhabi Bank Account or Card Balance (2026 Guide)

In the UAE, bank balance visibility is no longer just a convenience—it’s a compliance, salary, and cash-flow necessity. From WPS salary disbursements on Ratibi cards to real-time credit exposure monitoring for businesses, First Abu Dhabi Bank (FAB) has built one of the most diversified balance-inquiry ecosystems in the region. Yet confusion persists because FAB accounts, prepaid cards, salary cards, and digital wallets do not all use the same balance-checking logic or platforms.

This guide resolves that fragmentation.

Below is a single, authoritative resource explaining every official way to perform a FAB bank balance check in the UAE, how each method works, who it is for, and where users commonly make mistakes.

What “FAB Balance Check” Actually Means

The term “FAB balance check” refers to different financial entities, depending on the product you hold:

- FAB Current or Savings Account → Traditional bank account balance

- FAB Credit Card → Available credit vs outstanding balance

- FAB Ratibi Card → WPS salary balance (prepaid, not a bank account)

- FAB Prepaid Card → Stored-value balance issued via Magnati

- FAB-linked Digital Wallet (Payit) → Wallet balance synced to FAB instruments

Understanding which FAB product you use is essential because not all balance-check methods apply universally.

The Fastest Way to Check FAB Balance in the UAE

For most users in 2026, speed and accuracy determine the best method.

Ranking by efficiency:

- FAB Mobile App (accounts, cards, Ratibi)

- Magnati Prepaid Card Inquiry Portal (Ratibi & prepaid only)

- FAB Online Banking (desktop users)

- ATM Balance Inquiry (offline)

- SMS Banking (basic phones)

- Phone Banking / AI Virtual Agent

- Branch Visit (last resort)

Each method exists for a specific user context, which we explain below.

1. FAB Mobile App (Accounts, Credit Cards, and Ratibi Cards)

The FAB Mobile App is the core digital banking interface of First Abu Dhabi Bank and represents the highest-trust, highest-capability balance inquiry channel for UAE residents. It is not merely a balance viewer but a regulated digital banking environment tied directly to Emirates ID–based identity verification.

From an entity perspective, the app connects multiple FAB products under a single user profile: current accounts, savings accounts, credit cards, and salary-linked Ratibi cards. Once authenticated, balances shown inside the app are real-time reflections of FAB’s core banking ledger, not cached or delayed values.

The onboarding process itself explains why this method is prioritized by FAB. During first-time registration, users must validate their identity using their registered UAE mobile number, Emirates ID scan, and facial biometric verification. This process satisfies UAE Central Bank digital KYC requirements and ensures that balance data is only exposed to the verified account holder.

Inside the app, balances are separated clearly into available balance and ledger (total) balance, a distinction that is especially important for salary earners and credit card users. Pending card transactions, merchant holds, or uncleared deposits are reflected accurately, preventing the common misunderstanding that funds are “missing.”

For Ratibi cardholders, the app acts as a bridge between prepaid salary infrastructure and full digital banking visibility. While a Ratibi card is technically not a bank account, FAB allows eligible Ratibi users to view balances, salary credits, and transaction history through the same interface, reducing dependence on external portals.

From a behavioral standpoint, FAB Mobile App usage is favored by:

- Salaried UAE residents

- Business owners monitoring cash flow

- Frequent travelers requiring instant balance confirmation

- Users needing statements, alerts, or card controls

Because of biometric login, device binding, and session timeout controls, this method is considered the most secure balance-check option FAB offers.

Recommended: Best Credit Card in the UAE

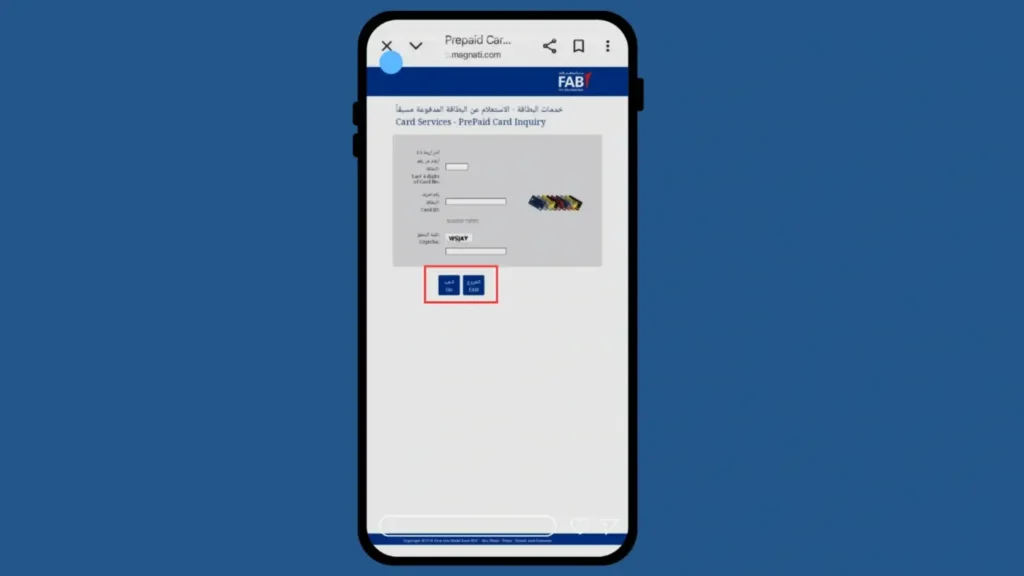

2. Magnati Prepaid Card Inquiry Portal (Ratibi & Prepaid Cards Only)

The Magnati Prepaid Card Inquiry Portal exists because not all FAB-issued cards are bank accounts, and this distinction is critical in the UAE’s wage and prepaid ecosystem.

Magnati is FAB’s regulated payment services arm, responsible for issuing and managing prepaid instruments, including:

- Ratibi salary cards

- Payroll cards for WPS compliance

- Certain travel, gift, and allowance cards

The portal is intentionally designed to work without a login, without an app, and without Emirates ID scanning, because many prepaid card holders are either unbanked or semi-banked. Instead of identity-based login, the system relies on card-level verification using the Card ID and partial card number.

When a user accesses the portal, the balance displayed represents the stored-value balance on that specific card, not a bank ledger. This means:

- No overdraft

- No pending-clearing concept like bank accounts

- Only loaded or credited funds are shown

The portal also exposes information that is not always visible elsewhere, such as:

- Card activation status

- Expiry state

- Limited recent transaction history

- Reload pathways (where applicable)

From a compliance angle, this portal supports the UAE Wage Protection System by allowing employees to independently verify that salaries have been credited, without requiring employer involvement or branch visits.

This method is most relevant for:

- Blue-collar and contract workers

- Employees without online banking access

- Users holding only a FAB prepaid card

Importantly, this portal cannot show bank account balances, credit card limits, or investment products. Its scope is deliberately narrow but operationally critical.

Recommended: Zero Balance Salary Account in UAE

3. FAB Online Banking (Desktop and Power Users)

FAB Online Banking represents the full-featured, browser-based interface connected directly to FAB’s core banking systems. Unlike the mobile app, which emphasizes speed and everyday access, the desktop portal is designed for depth, review, and documentation.

Balances shown here are authoritative and detailed, often used for:

- Accounting reconciliation

- Audit preparation

- Loan documentation

- Business finance reviews

One defining feature of online banking is the visibility of multiple accounts simultaneously, including foreign currency accounts, joint accounts, and business-linked profiles. This makes it the preferred environment for balance checking among SMEs, investors, and high-net-worth individuals.

The system uses multi-factor authentication, typically involving OTP verification sent to a registered mobile number or email. Sessions automatically expire after inactivity, which aligns with UAE banking cybersecurity standards.

Balance data here is broken down with contextual clarity. Users can see:

- Available balance

- Ledger balance

- Currency denomination

- Transaction timestamps

- Posting vs value dates

This matters because many UAE users manage cross-border transfers, salary inflows, and scheduled payments. The online portal provides the clearest explanation of why a balance looks the way it does.

While it requires internet access and credentials, this method is considered the most transparent and document-ready balance source FAB provides.

Recommended: Prepaid Card Inquiry in the UAE

4. ATM Balance Inquiry (Offline and Immediate)

ATM balance inquiry remains one of the most resilient and universally accessible methods in the UAE banking system. FAB ATMs are connected directly to the bank’s transaction switch, meaning balances displayed are live and authoritative, even without internet access.

This method is particularly important for:

- Users with limited digital literacy

- Individuals without smartphones

- Emergency situations where internet is unavailable

- Tourists holding FAB-issued cards

When a user performs a balance inquiry at an ATM, the system retrieves the balance tied to the card’s linked account or prepaid instrument. If multiple accounts are linked, the user may be prompted to choose between savings, current, or credit card views.

Receipts, when printed, act as time-stamped proof of balance, often used for rent verification or employer confirmation.

From a regulatory perspective, ATM balance inquiry is considered a low-risk transaction, which is why it remains available 24/7 without additional authentication beyond the PIN.

5. SMS Banking (Basic Phones and Low Connectivity Environments)

SMS banking exists because banking access in the UAE must account for all demographics, including users without smartphones or stable internet connections.

FAB’s SMS balance inquiry system operates through a command-based interface, where a structured message retrieves balance information from the bank’s servers and returns it as text.

The balance provided typically includes:

- Available balance

- Ledger balance

- Masked account reference

- Recent transaction indicator

This system uses a dedicated SMS PIN, separate from ATM or app credentials, which limits damage if a phone is lost or compromised.

SMS banking is especially relevant in:

- Labor accommodations

- Remote work sites

- International roaming situations

While it lacks a detailed transaction context, it fulfills its core function: quick confirmation of available funds.

6. Phone Banking and AI Virtual Agent

FAB’s phone banking system has evolved from traditional IVR into an AI-assisted conversational interface, capable of understanding natural language requests.

When a user calls FAB customer care, they interact first with an AI virtual agent trained to handle balance inquiries, transaction summaries, and basic service requests. This agent uses voice recognition and contextual prompts rather than rigid menus.

Balance information provided through this channel is read directly from the core banking system, following identity verification through personal data points such as date of birth, Emirates ID digits, or PIN.

If the AI system detects complexity, uncertainty, or security risk, the call is escalated to a human representative.

This method is particularly valuable for:

- Elderly users

- Visually impaired users

- Non-digital customers

- Complex account scenarios

It combines automation efficiency with human fallback, which is why FAB continues to invest in it despite digital adoption growth.

7. Branch Visit (Last-Resort and Exception Handling)

Visiting a FAB branch to check balance is no longer a primary method, but it remains essential for exception cases.

Branches are used when:

- Digital access is blocked

- Identity details need correction

- Legal or compliance holds exist

- Official stamped statements are required

At the branch, balances are verified using original Emirates ID, and the information provided is considered legally authoritative. In some cases, branch verification is the only way to resolve discrepancies between displayed and actual balances.

Due to the limited banking hours in the UAE and the cost-intensive nature of branch operations, this method is best viewed as a resolution channel rather than a routine inquiry tool.

FAB Does Not Support: WhatsApp Banking Myth

Despite online claims, FAB does not offer WhatsApp banking.

- No balance checks via WhatsApp

- No official FAB WhatsApp service for customers

- Any WhatsApp message claiming otherwise is fraudulent

FAB has officially clarified that WhatsApp is not an authorized banking channel.

Security, Compliance & UAE Regulatory Context

FAB balance-checking systems comply with:

- UAE Central Bank regulations

- Wage Protection System (WPS)

- AML and KYC requirements

- Emirates ID–based digital identity frameworks

Users should never share OTPs, SMS PINs, or card details, even with callers claiming to be FAB.

FAQs

Is FAB balance updated in real time?

Yes. Mobile app, online banking, ATMs, and Magnati portals reflect real-time or near-real-time balances.

Can I check FAB balance without internet?

Yes. ATM, SMS banking, and phone banking do not require internet access.

Is Ratibi balance the same as a bank account balance?

No. Ratibi cards are prepaid salary instruments, not bank accounts.

Does FAB charge for balance inquiries?

No charges apply for app, online banking, or FAB ATM balance checks.

Can tourists check FAB balance?

Yes, if they hold a FAB card. ATM and phone banking are most commonly used.

Why is my available balance lower than my total balance?

Pending card transactions, holds, or uncleared deposits may reduce available balance.

Is WhatsApp balance check safe?

FAB does not support WhatsApp banking. Any such message is a scam.

Conclusion

This guide is maintained to reflect current UAE banking practices and FAB’s official service structure, ensuring EmiratesBreaking.com remains a primary reference point for finance and banking clarity in the region.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.