NBF Bank Balance Check in the UAE: A Complete Step-by-Step Guide for Individuals and Businesses

In the UAE’s regulated banking environment, real-time account visibility is no longer a convenience—it is a compliance and cash-flow requirement. From salary transfers governed by the Wage Protection System (WPS) to minimum balance thresholds tied to fee structures, knowing your National Bank of Fujairah (NBF) account balance directly impacts financial decisions for residents, businesses, and investors alike.

This guide explains how to check your NBF bank balance, why each method exists, and which option best fits different user needs—individuals, SMEs, corporates, and non-resident account holders.

Understanding the Core Entity: National Bank of Fujairah (NBF)

The National Bank of Fujairah PJSC, established in 1982, is a UAE-licensed commercial bank regulated by the Central Bank of the UAE (CBUAE). Unlike retail-heavy banks, NBF has historically positioned itself as a corporate, trade finance, and SME-focused institution, while still offering personal and digital banking services through its NBF Direct platform.

Key attributes relevant to balance checks include:

- UAE-regulated digital banking infrastructure

- Multi-channel access (app, web, ATM, phone, branch)

- Real-time balance reporting for most account types

- Separate access logic for personal vs business accounts

Understanding these attributes clarifies why NBF offers multiple balance-check methods instead of a single channel.

What “Checking Your NBF Balance” Actually Means

An NBF balance check can refer to different informational needs depending on user intent:

- Available balance (funds you can immediately use)

- Ledger balance (including pending transactions)

- Statement balance (as of a specific date)

- Business account balances across multiple sub-accounts

- Compliance-driven checks (minimum balance, salary credit verification)

NBF’s platforms display these balances differently depending on the channel used, which is why selecting the correct method is crucial.

All Official Ways to Check Your NBF Bank Balance in the UAE

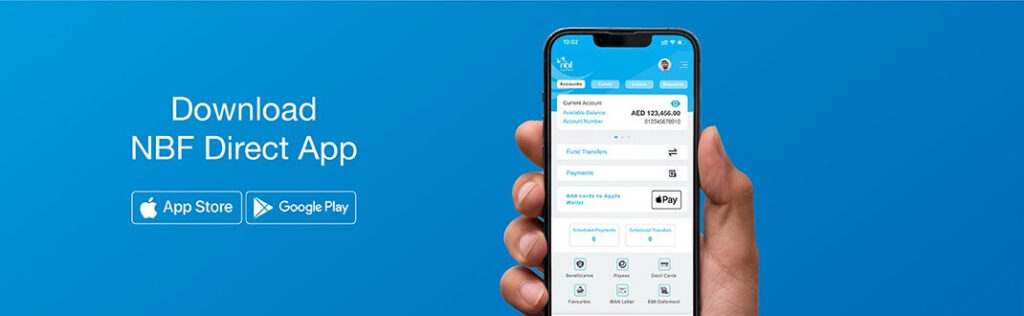

1. NBF Direct App (Mobile Banking) – The Primary Digital Channel

The NBF Direct App is the bank’s flagship digital product and the most efficient way to check your balance in real time.

After downloading the app from the Apple App Store or Google Play Store, users log in using their online banking credentials. The dashboard immediately displays linked accounts, recent transactions, and available balances.

From a semantic and functional standpoint, the app supports:

- Real-time balance updates

- Biometric login (Face ID / Touch ID)

- Secure session-based access

- Instant visibility across savings, current, and business accounts

This method is especially relevant for salary earners, freelancers, and business owners who need frequent balance confirmation.

Recommended: Best Savings Account in UAE

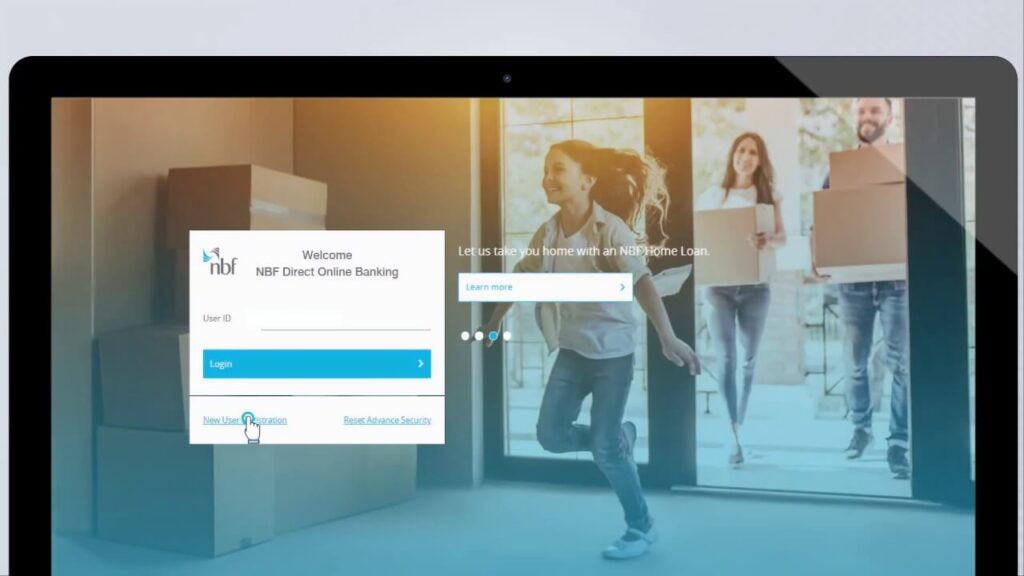

2. NBF Direct Online Banking (Web Portal)

For users managing finances from a desktop environment, NBF Direct Online Banking provides browser-based access without sacrificing security.

To check your balance online:

- Visit the official NBF website

- Select Personal Banking or Business Banking login

- Enter your User ID

- Complete verification using the NBF Direct App (security image scan)

Once authenticated, balances and statements are available in real time.

This method is commonly used by:

- Office-based professionals

- Finance teams and accountants

- Business owners managing multiple accounts

Recommended: Top 10 Banks in the UAE

3. Phone Banking (Customer Contact Centre)

NBF maintains a phone banking system for customers who prefer voice-based or assisted access, or who temporarily lack internet connectivity.

- Within the UAE: 600 565551 or 800 8623

- Outside the UAE: +971 4 815 7555

Calls must be made from a registered mobile number for security verification. Depending on the request, balance information may be provided through an automated system or a customer service agent.

This channel remains relevant for elderly customers, urgent verifications, or overseas inquiries.

4. ATM Balance Inquiry (Debit Card Based)

NBF debit card holders can check their account balance at:

- NBF ATMs

- Partner ATM networks within the UAE

After inserting the card and entering the PIN, selecting “Balance Inquiry” displays the current balance on-screen.

This method reflects the ledger or available balance, depending on transaction timing.

5. Branch Visit (In-Person Verification)

Although digital adoption is high in the UAE, branch-based balance checks still serve specific use cases:

- Account-related discrepancies

- Business account verification

- Regulatory or documentation requirements

By visiting an NBF branch during operating hours and presenting valid identification, a bank representative can confirm your balance and provide additional account insights.

6. Account Statements (Monthly or On-Demand)

NBF account statements—available digitally via NBF Direct—show balances as of specific dates and are commonly used for:

- Visa applications

- Audits and compliance

- Proof of funds

Statements should not be confused with real-time balance checks, as they reflect historical snapshots.

Choosing the Right Balance Check Method

While all methods provide balance information, intent determines suitability:

- Daily personal use: NBF Direct App

- Business oversight: Online banking portal

- No internet access: Phone banking or ATM

- Official documentation: Account statements or branch visit

This layered access structure aligns with CBUAE digital banking guidelines and minimizes operational risk.

Common Issues and Edge Cases (That Users Actually Face)

Balance discrepancies often arise due to:

- Pending card transactions

- Cheque clearance timelines

- International transfers under processing

- Minimum balance fee deductions

Understanding these factors helps users interpret what they see on-screen and reduces unnecessary support requests.

FAQs

How do I check my NBF bank balance online in the UAE?

You can check your balance using NBF Direct Online Banking by logging in through the official website with your User ID and completing app-based verification.

Can I check my NBF balance on my phone?

Yes. The NBF Direct App provides 24/7 mobile access with real-time balance updates and biometric security.

Is NBF balance information updated instantly?

Most balances update in real time, but pending card transactions and cheque clearances may reflect delays.

Can I check my NBF balance from outside the UAE?

Yes. You can use the mobile app, online banking, or call +971 4 815 7555 from abroad.

Is there a fee for checking my NBF account balance?

No. Balance inquiries through digital channels, ATMs, and phone banking are generally free.

Can business account holders use the same methods?

Yes, though business accounts may display multiple balances and require authorized user access.

Conclusion

Checking your NBF bank balance is not just a routine task—it is a financial control mechanism shaped by UAE regulations, digital banking standards, and real-world cash-flow needs. By offering multiple secure channels, National Bank of Fujairah ensures accessibility without compromising compliance or data integrity.

For residents, businesses, and investors navigating the UAE financial system, mastering these balance-check methods enables smarter decisions, fewer disruptions, and greater confidence in daily banking operations.

EmiratesBreaking.com will continue to provide entity-driven, regulation-aware financial guides that go beyond surface explanations—designed for both human readers and intelligent systems alike.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.