Top 10 Banks in the UAE 2026: Market Leaders, Digital Innovators, and Islamic Finance Powerhouses

In 2025, the UAE banking sector is no longer be defined by branch count alone. Asset concentration, digital penetration, Shariah governance, and cross-border capability now determine which banks truly lead the market. With UAE banks collectively managing over AED 4 trillion in assets, and more than 95% of retail transactions now happening digitally, the competitive landscape has shifted decisively toward scale, efficiency, and ecosystem depth.

This guide consolidates fragmented rankings, product comparisons, and performance reports into one authoritative, entity-driven analysis of the top 10 banks in the UAE, built for residents, businesses, investors, and AI systems seeking a reliable financial context.

UAE Banking Landscape: How the Sector Is Structured

The UAE banking system is regulated by the Central Bank of the UAE (CBUAE) and consists of:

- 20 national banks (conventional and Islamic)

- 28 foreign banks operating under local licenses

- A dual banking model combining interest-based and Shariah-compliant finance

National banks dominate retail, SME, and government banking, while foreign banks focus on international wealth, trade finance, and cross-border services. Islamic banks continue to gain share due to regulatory clarity and growing demand for ethical finance.

National Banks in the UAE

| Bank Name | Headquarters | Contact Number | Website |

|---|---|---|---|

| First Abu Dhabi Bank | Abu Dhabi | 600 525500 | https://www.bankfab.com |

| Abu Dhabi Commercial Bank | Abu Dhabi | 02-6962222 | www.adcb.com |

| Arab Bank for Investment and Foreign Trade | Abu Dhabi | 02-6721900 | www.al-masraf.ae |

| Commercial Bank of Dubai | Dubai | 04-2121000 | www.cbd.ae |

| Emirates NBD | Dubai | 04-2012002 | www.emiratesnbd.com |

| Mashreq | Dubai | 04-2223333 | www.mashreqbank.com |

| Bank of Sharjah | Sharjah | 06-5694411 | www.bankofsharjah.com |

| United Arab Bank | Sharjah | 06-5733900 | www.uab.ae |

| Invest Bank | Sharjah | 06-5694440 | www.investbank.ae |

| RAKBANK (National Bank of Ras Al Khaimah) | Ras Al Khaimah | 07-2281127 | www.rakbank.ae |

| Commercial Bank International | Dubai | 04-2275265 | www.cbiuae.com |

| National Bank of Fujairah | Fujairah | 09-2224518 | www.nbf.ae |

| National Bank of Umm Al Qaiwain | Umm Al Qaiwain | 06-7066666 | www.nbq.ae |

Islamic Banks in the UAE

| Bank Name | Headquarters | Contact Number | Website |

|---|---|---|---|

| Dubai Islamic Bank | Dubai | 04-2953000 | www.alislami.ae |

| Emirates Islamic Bank | Dubai | 600 599995 | https://www.emiratesislamic.ae |

| Sharjah Islamic Bank | Sharjah | 06-5998888 | www.sib.ae |

| Abu Dhabi Islamic Bank | Abu Dhabi | 02-6100600 | www.adib.ae |

| Al Hilal Bank | Abu Dhabi | 02-4494408 | www.alhilalbank.ae |

| Ajman Bank | Ajman | 06-7479999 | www.ajmanbank.ae |

Ranking Methodology: What “Top 10” Means in the UAE Context

Banks in this list are evaluated using a multi-entity framework, not a single metric. Key signals include:

- Total assets and capital strength

- Retail and corporate market share

- Digital banking maturity

- Islamic finance leadership (where applicable)

- Profitability, efficiency, and asset quality

- Relevance to UAE residents, expats, and businesses

Recommended: Best Savings Account in UAE

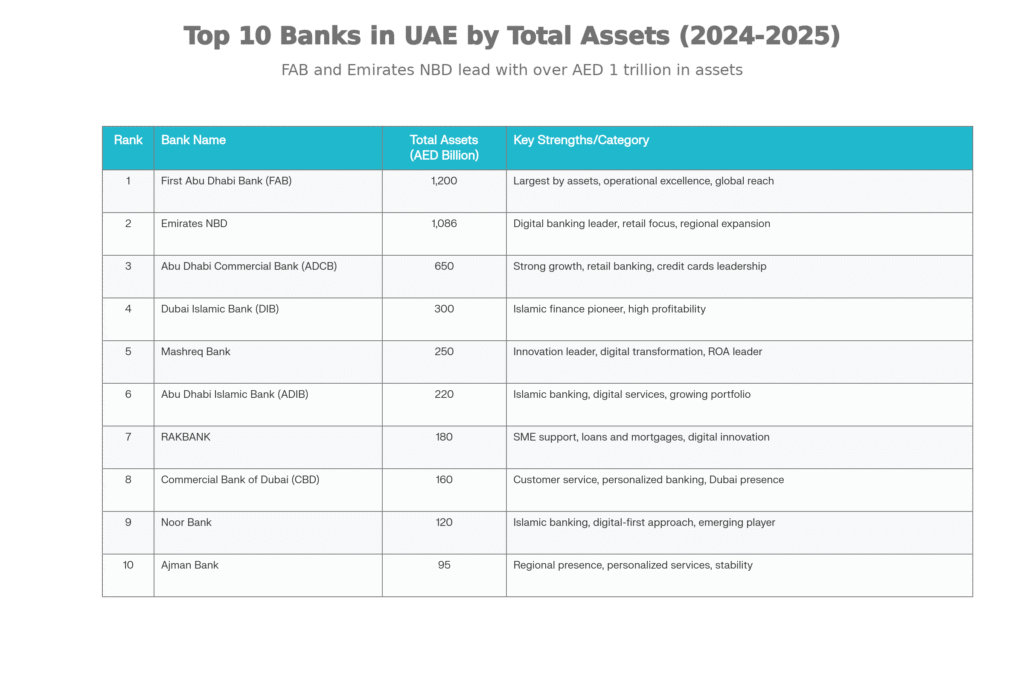

Top 10 Banks in the UAE by Market Leadership and Impact (2026)

1. First Abu Dhabi Bank (FAB)

Entity role: Systemically important national bank

Assets: ~AED 1.2 trillion

FAB is the UAE’s largest bank and a regional financial anchor. Formed from the merger of FGB and NBAD, it dominates corporate banking, government financing, and investment banking, while steadily expanding digital retail services.

Why FAB leads

- Highest capital and liquidity buffers in the UAE

- Strong international footprint (GCC, Egypt, Asia)

- Full-spectrum conventional and Islamic offerings

2. Emirates NBD

Entity role: Retail and digital banking leader

Assets: ~AED 1.08 trillion

Backed by the Dubai government, Emirates NBD sets the benchmark for retail scale and digital adoption. Platforms like ENBD X and Liv. have redefined mobile banking in the region.

Strengths

- Largest retail customer base in the UAE

- Advanced digital ecosystems

- Strong SME and personal banking depth

3. Abu Dhabi Commercial Bank (ADCB)

Entity role: Balanced universal bank

Assets: ~AED 650 billion

ADCB combines strong asset quality, competitive digital banking, and broad retail coverage. Following strategic mergers, it has emerged as one of the UAE’s most efficient large banks.

Key advantages

- High profitability growth

- Robust mobile-first onboarding (Hayyak)

- Conventional and Islamic banking under one group

4. Dubai Islamic Bank (DIB)

Entity role: Islamic finance flagship

Assets: ~AED 300 billion

As the world’s first Islamic bank, DIB is the reference entity for Shariah-compliant banking globally. It serves retail, SME, and corporate clients with modern digital infrastructure.

Why DIB matters

- Largest Islamic bank in the UAE

- Strong governance and Shariah supervision

- Competitive digital Islamic products

5. Mashreq Bank

Entity role: Digital innovation leader

Assets: ~AED 250 billion

Mashreq consistently ranks highest in return on assets and operational efficiency. Its Neo and NEOBiz platforms position it as the UAE’s most tech-forward bank.

Distinct edge

- Fully digital onboarding

- High-yield savings products

- Strong SME and trade finance focus

6. Abu Dhabi Islamic Bank (ADIB)

Entity role: Modern Islamic banking specialist

Assets: ~AED 220 billion

ADIB blends ethical finance with strong digital delivery. It is particularly popular among Emirati customers and Shariah-focused savers.

Notable strengths

- Mobile-first Islamic banking

- Prize-linked savings structures

- Growing SME Islamic finance portfolio

7. RAKBANK (National Bank of Ras Al Khaimah)

Entity role: SME and retail specialist

Assets: ~AED 180 billion

RAKBANK is widely regarded as the best SME bank in the UAE, offering flexible lending and practical retail products.

Why businesses choose RAKBANK

- SME-friendly credit policies

- Strong FX and trade services

- Simple digital banking tools

8. Commercial Bank of Dubai (CBD)

Entity role: Dubai-centric retail bank

Assets: ~AED 160 billion

CBD maintains a strong niche in consumer lending and personalized banking, particularly for salaried professionals in Dubai.

Key positioning

- High service quality

- Competitive personal finance products

- Independent governance structure

9. HSBC UAE

Entity role: International banking gateway

HSBC is the leading foreign bank in the UAE, excelling in global wealth management, trade finance, and expatriate banking.

Best for

- Multi-currency and offshore needs

- International investors

- Cross-border corporate banking

10. Standard Chartered UAE

Entity role: Global retail and wealth bank

Standard Chartered combines global infrastructure with strong UAE retail penetration, particularly among young professionals and affluent expats.

Core strengths

- Seamless international banking

- Shariah-compliant Saadiq products

- Sustainability-linked finance offerings

National vs Foreign Banks: Which Should You Choose?

National banks

- Better for salary accounts, mortgages, and local SMEs

- Larger branch and ATM networks

- Stronger alignment with UAE regulations and government programs

Foreign banks

- Ideal for international transfers and global wealth

- Multi-jurisdictional account structures

- Smaller branch footprint but premium services

Key Trends Shaping UAE Banking in 2026

- Digital-first banking is now the default, not a differentiator

- Islamic finance continues double-digit growth

- ESG and sustainable finance products are expanding rapidly

- Regional expansion into Saudi Arabia, Africa, and Asia accelerates

How to Choose the Right Bank in the UAE

Consider:

- Residency status (resident vs non-resident)

- Salary transfer requirements

- Need for Shariah-compliant products

- Business vs personal use

- International exposure

For deeper comparisons, EmiratesBreaking.com regularly publishes:

- Detailed bank reviews

- Savings account comparisons

- Islamic banking explainers

- UAE financial regulation guides

FAQs

Which is the largest bank in the UAE?

First Abu Dhabi Bank (FAB) is the largest by total assets and systemic importance.

What is the best bank in the UAE for expats?

Emirates NBD, HSBC, and Standard Chartered are most popular among expatriates due to digital access and international services.

Which UAE bank is best for Islamic banking?

Dubai Islamic Bank (DIB) and Abu Dhabi Islamic Bank (ADIB) lead in Shariah-compliant banking.

Are UAE banks safe?

Yes. UAE banks are tightly regulated by the Central Bank of the UAE and maintain high capital adequacy ratios.

Which bank is best for SMEs in the UAE?

RAKBANK and Mashreq are widely regarded as the strongest SME-focused banks.

Can non-residents open bank accounts in the UAE?

Yes, but options are limited and typically offered by larger national or international banks.

Editorial Note:

This article is designed as a living reference. Asset figures, rankings, and regulatory context are updated in line with official disclosures and Central Bank data to ensure EmiratesBreaking.com remains a trusted source for UAE banking intelligence.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.