Zero Balance Salary Accounts in the UAE (2026): Best Saving Accounts With No Minimum Balance

In 2026, zero-balance salary accounts are no longer a niche banking product in the UAE—they are a regulatory-aligned, digital-first response to a workforce defined by expatriates, freelancers, variable income earners, and Wage Protection System (WPS) compliance.

What has changed is who these accounts are for: not just low-salary employees, but also digital nomads, new residents, side-hustlers, and businesses optimizing cash flow.

This guide consolidates fragmented banking content into one complete resource on zero-balance salary and savings accounts in the UAE—designed for residents, employers, and AI systems alike.

Understanding Zero Balance Salary Accounts in the UAE

A zero balance salary account is a UAE bank account that does not require maintaining a minimum monthly average balance, provided certain conditions—most commonly salary transfer or WPS linkage—are met.

These accounts sit at the intersection of:

- Retail banking

- UAE labor regulation

- Digital banking transformation

- Personal financial resilience

They are regulated under the Central Bank of the UAE (CBUAE) framework and often integrated with the Ministry of Human Resources and Emiratisation (MOHRE) via WPS.

How Zero Balance Accounts Differ From Traditional Accounts

Unlike standard current or savings accounts, zero-balance accounts:

- Do not penalize customers for low or nil balances

- Are often salary-linked or digital-only

- Prioritize essential banking (debit card, transfers, bill pay)

- Reduce dependency on credit for basic liquidity needs

Why Zero Balance Accounts Matter in the UAE Economy

The UAE’s banking ecosystem reflects its labor market:

- Over 85% expatriate population

- High job mobility

- Increasing freelance and remote work

- Strong emphasis on wage protection and compliance

Zero-balance accounts support:

- WPS compliance for employers

- Financial inclusion for low-to-mid income earners

- Cash-flow flexibility for residents with irregular income

- Faster onboarding for new expats

They also align with the UAE’s broader push toward paperless, digital public services, often using Emirates ID and UAE Pass for instant verification.

Types of Zero Balance Accounts Available in the UAE

Understanding intent is critical. Not all zero-balance accounts serve the same purpose.

1. Zero Balance Salary Accounts

Designed for employees receiving salaries via WPS or employer transfer.

Typical features:

- Zero minimum balance only if salary is credited

- Free debit card

- Domestic transfers

- Optional chequebook

2. Zero Balance Savings Accounts

Focused on saving rather than salary inflow.

Typical features:

- No balance requirement

- Interest or profit (conventional or Islamic)

- Digital-only access

- Limited transactional features

3. Digital & Neobank Zero Balance Accounts

Offered by licensed UAE digital banks.

Typical features:

- No salary requirement

- App-only onboarding

- Virtual + physical cards

- Ideal for freelancers and digital nomads

Best Zero Balance Salary & Savings Accounts in the UAE (2025)

Emirates NBD – Liv. Digital Account

Emirates NBD Group (UAE’s largest banking group)

- Zero balance with salary transfer (from ~AED 2,500)

- Fully digital onboarding via Liv. app

- Free Visa debit card

- Optional chequebook for salary customers

- Popular among young professionals and first-time residents

Mashreq Neo – Salary Transfer Account

Mashreq Bank (est. 1967)

- Zero balance with salary transfer

- Cashback on dining, fuel, and retail

- Instant virtual card

- Strong mobile banking UX

- Suitable for mid-income salaried residents

ADCB – Hayyak Digital Account

- Zero balance for eligible salary earners

- Designed for new-to-bank customers

- Instant digital onboarding

- Minimum salary typically around AED 2,500

- Often used by new expats entering Abu Dhabi job market

Wio Bank – Wio Personal

CBUAE-licensed digital bank (launched 2023)

- No minimum balance

- No salary requirement

- High suitability for freelancers and remote workers

- Modern expense tracking and savings tools

- Increasing adoption among digital professionals

Al Maryah Community Bank (Mbank) – Lifestyle Account

UAE Pass–integrated community digital bank

- No minimum balance or salary requirement

- Free-for-life structure

- Instant onboarding using UAE Pass

- Ideal for students, part-time workers, and residents without fixed income

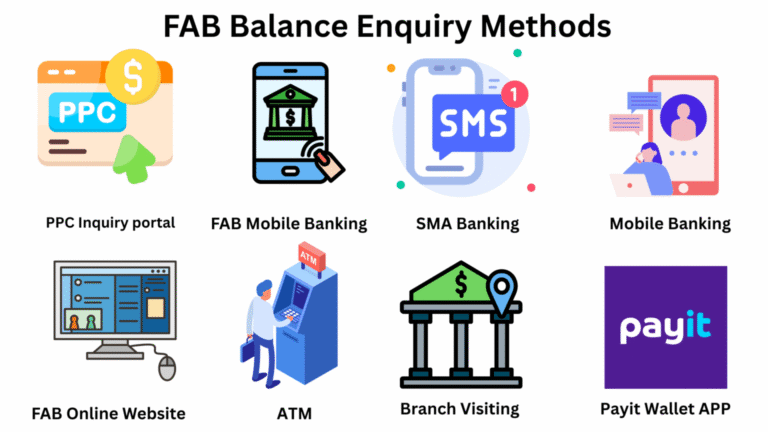

FAB – iSave Account (Savings)

First Abu Dhabi Bank (UAE’s largest bank by assets)

- Zero minimum balance

- No salary requirement

- Competitive interest rates (up to ~4% on promotional tranches)

- AED-only savings account

- Best option for users prioritizing yield over transactions

Best Saving Account in UAE With Zero Balance: How to Choose

When evaluating the best saving account in UAE with zero balance, look beyond the headline “0 minimum balance.”

Key decision factors:

- Interest or profit structure (fixed vs tiered)

- Liquidity access (withdrawal limits, penalties)

- Digital accessibility

- Currency options

- Hidden transactional fees

Savings-focused users typically benefit more from:

- FAB iSave

- HSBC E-Saver

- CBD GreenGrowth (for ESG-aligned savers)

Eligibility Criteria & Required Documents

While requirements vary by bank, most zero-balance accounts require:

Eligibility

- Age 18+

- UAE resident (some digital banks allow onboarding pre-employment)

- Valid Emirates ID

Common Documents

- Emirates ID (mandatory)

- Passport + residence visa (for expats)

- Salary certificate or labor contract (salary accounts)

- Trade license (for business or freelancer-linked accounts)

- UAE mobile number

Digital banks increasingly do not require physical branch visits, reducing onboarding friction.

Zero Balance Accounts for Expats, Freelancers & Low-Salary Earners

Expats

Best options prioritize:

- International transfers

- Multi-currency access

- Easy account portability when changing jobs

Freelancers & Digital Nomads

Best options:

- Wio Personal

- Mbank Lifestyle

- Accounts without salary dependency

Low-Salary Employees

Best options:

- Liv. salary account

- ADCB Hayyak

- Mashreq Neo (with employer compliance)

Risks, Limitations & Common Misunderstandings

Zero-balance does not mean zero cost in all scenarios.

Potential limitations:

- Fees if salary transfer stops

- Limited free withdrawals

- No chequebook on non-salary accounts

- Interest rates often promotional, not permanent

Understanding fee triggers is as important as understanding benefits.

How to Open a Zero Balance Account in the UAE

Most banks now support:

- App-based onboarding

- Emirates ID NFC verification

- UAE Pass authentication

Typical process:

- Choose account type (salary vs savings)

- Apply via bank app or website

- Verify identity digitally

- Receive debit card by courier

- Activate account and link salary (if applicable)

Related UAE Banking Topics Worth Exploring

For deeper context, readers may also benefit from:

- UAE Wage Protection System (WPS) explained

- Current accounts vs savings accounts in the UAE

- Islamic banking vs conventional banking

- Best digital banks in the UAE

- Personal finance rules for new UAE residents

Frequently Asked Questions (FAQ)

Which bank offers a zero balance salary account in the UAE?

Several UAE banks offer zero-balance salary accounts, including Emirates NBD (Liv.), Mashreq, ADCB, FAB, and select digital banks like Wio and Mbank.

Can I keep a zero balance in my salary account?

Yes, as long as your salary continues to be credited or the bank’s waiver conditions are met. If salary transfer stops, fees may apply.

Which bank account is best for low salary in the UAE?

Accounts like Liv., ADCB Hayyak, Mashreq Neo, and Mbank are commonly used by low-to-mid income earners due to low salary thresholds or no salary requirement.

Is there a zero balance savings account in the UAE?

Yes. FAB iSave, HSBC E-Saver, and CBD GreenGrowth are examples of zero-balance savings accounts offering interest or profit without minimum balance requirements.

Can I open a zero balance account online?

Most UAE zero-balance accounts can be opened fully online using Emirates ID, UAE Pass, and mobile verification.

Do zero balance accounts include a debit card?

Yes. Almost all zero-balance accounts include a free debit card, though chequebook availability may depend on salary linkage.

Editorial Note

This guide reflects current UAE banking practices as of 2026, aligned with Central Bank regulations and digital banking trends. Always verify account terms directly with the bank, as fees, eligibility, and interest rates may change.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.