What Is CIF in Banking & Why Every Bank Customer Has One

Walk into any UAE bank, open an account, and within seconds the system generates something more important than your account number — your CIF number.

Most customers never notice it until a loan officer, call center agent, or relationship manager asks: “Can you share your CIF?”

At that moment, confusion starts.

- Is it your IBAN?

- Your account number?

- Something you must apply for?

None of the above.

In the UAE banking system, the Customer Information File (CIF) number is automatically created the moment you become a customer. It quietly becomes your permanent identity inside that bank’s database, linking every product and service you ever use.

Understanding how it works — and how to retrieve it quickly — can save you time during support calls, credit applications, or account updates.

This guide explains everything clearly, from what a CIF actually is to the exact ways you can find yours across UAE banks.

What Is a CIF Number?

A CIF (Customer Information File) number is a unique customer identification number assigned by banks to consolidate all of your financial relationships under one profile.

Instead of treating each account separately, banks create one central record containing your:

- Emirates ID and KYC information

- Contact details

- Savings and current accounts

- Debit and credit cards

- Loans and financing

- Transaction history

- Risk and compliance records

This record is labeled with your CIF.

Think of it as your master banking identity, not an account.

If you hold three accounts, two cards, and one loan, the bank still sees you as one customer – because everything is connected to a single CIF.

Why CIF Numbers Exist in UAE Banking

CIF numbers are not just administrative labels. They are part of how modern banking systems operate securely and efficiently.

From a regulatory perspective, UAE banks must comply with strict Know Your Customer (KYC) and anti-money laundering (AML) rules set by the Central Bank of the UAE. A centralized customer file makes this possible by grouping all products and transactions under one verified identity.

Operationally, CIF numbers allow banks to provide faster service. When you contact customer support or apply for financing, staff can instantly view your entire relationship with the bank instead of searching multiple accounts individually.

This improves:

- Account management

- Loan approvals

- Fraud monitoring

- Customer service response time

- Compliance checks

Without a CIF, none of this could be streamlined.

CIF vs Account Number vs IBAN: Understanding the Difference

Many customers assume their CIF is simply another account number. It is not.

An account number identifies one specific account, such as your salary or savings account. If you open another account, you receive another number.

An IBAN is used only for payments and transfers.

A CIF, however, identifies you personally. You typically have only one per bank, no matter how many accounts you open.

So if you bank with Emirates NBD and hold four different products, all of them sit under the same CIF profile. If you open an account with another bank, such as FAB, that bank creates a completely new CIF for you.

Each bank maintains its own system independently.

Recommended: FAB Balance Check

How to Get Your CIF Number in the UAE

There is an important clarification many people miss: you do not apply for a CIF number. It is automatically created when your first account is opened.

What you are really doing is retrieving it.

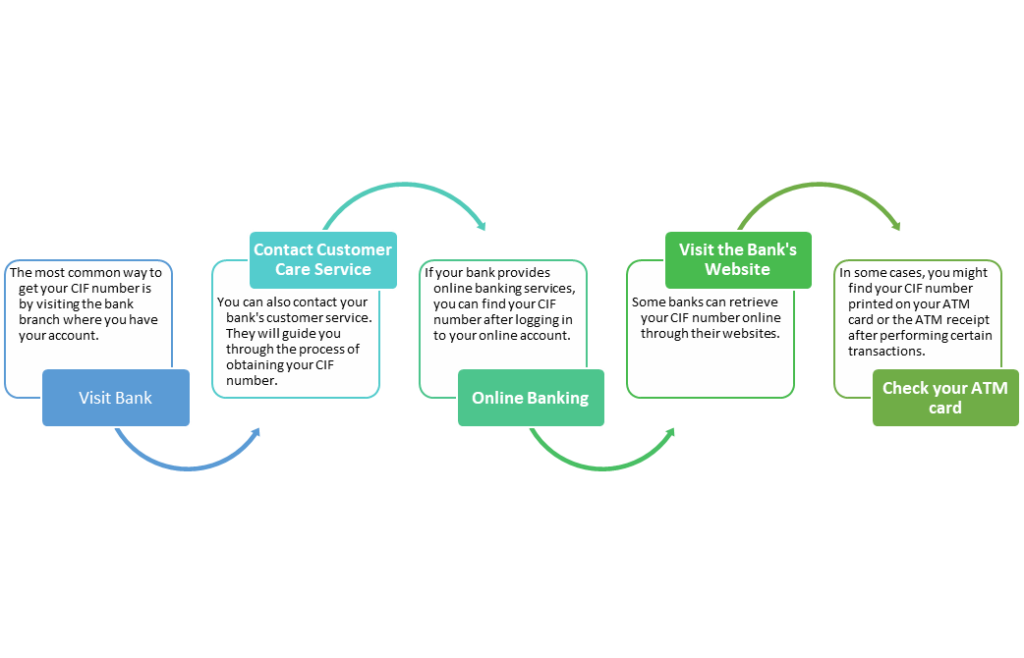

Fortunately, banks make this simple through digital and physical channels.

The fastest method today is through your bank’s mobile app. After logging in, most UAE banking apps display your customer ID or CIF inside the profile or account details section. It is usually located near your name or account summary. Emirates NBD, ADCB, FAB, Dubai Islamic Bank, Mashreq, and other major banks follow this standard layout.

If you prefer desktop access, online banking portals show the same information inside the customer profile or dashboard. Many customers also find their CIF printed on downloadable e-statements, typically near the header or personal details section.

For those who still use physical documents, cheque books and welcome kits often include the customer number on the first page. Some banks even print it directly on the debit card.

If digital and paper options are unavailable, you can call customer service or visit a branch with your Emirates ID. After verification, staff will provide your CIF immediately.

In practice, most customers retrieve it within minutes using their mobile app.

Bank-Specific Practices in the UAE

While the concept of a CIF is consistent across all banks, the display format may vary slightly.

Emirates NBD and Emirates Islamic typically show it clearly within account details or statements. FAB often embeds it within account information but labels it as a customer number on statements. ADCB sometimes structures it within the first digits of the account number. CBI has been known to print the CIF on the front of debit cards.

Regardless of formatting, every bank provides it digitally or through customer support.

When You Actually Need Your CIF Number

Most daily transactions do not require your CIF, which is why many customers forget it exists. However, it becomes important in certain situations.

When applying for loans or credit cards, banks use your CIF to review your relationship history. During customer support calls, agents may request it to quickly locate your records. Business owners often need it when opening additional corporate accounts or discussing financing facilities. It also helps when updating personal information or resolving disputes.

In short, anytime the bank needs to view your entire profile rather than one account, the CIF becomes the primary reference.

Security Considerations

Although a CIF is not used to move money like an IBAN or card number, it is still sensitive personal information. It links directly to your financial profile and should be protected accordingly.

Never share your CIF along with OTPs, PINs, or passwords over the phone or messaging apps. UAE banks do not request such details through unsolicited calls. If someone claims to represent the Central Bank or your bank’s “security department,” hang up and contact the official hotline yourself.

Treat your CIF with the same caution you would give any banking identifier.

Broader Banking Context in the UAE

As the UAE continues expanding its digital banking ecosystem, identifiers like CIF numbers play an even bigger role. From instant account opening to automated credit scoring and mobile-first services, banks rely on unified customer files to reduce friction and improve compliance.

For residents, entrepreneurs, and investors operating across multiple banks, understanding how these identifiers work makes everyday banking more efficient and avoids unnecessary delays during applications or support requests.

For deeper insights into managing accounts, opening business banking facilities, or understanding regulatory processes, readers can explore related explainers on EmiratesBreaking.com covering UAE banking operations, balance checks, and corporate finance essentials.

FAQs

Do I need to apply for a CIF number in UAE?

No. It is automatically generated when you open your first account.

Can two customers share the same CIF?

No. Each customer has a unique ID per bank.

Is my CIF the same across different banks?

No. Every bank assigns a separate CIF.

Can I open multiple accounts with one CIF?

Yes. All accounts under one bank connect to the same CIF.

Where is CIF shown in the Emirates NBD app?

Usually under Account Details or Profile → Customer Information.

Is CIF required for loans?

Yes. Banks use it to check your history and credit relationship.

Is CIF confidential?

Yes. Treat it like sensitive banking information.

What if I lost my documents?

Use the mobile app, statements, or call customer care.

Conclusion

In the UAE banking system, your CIF number is the backbone of your financial identity.

It quietly connects everything:

accounts, cards, loans, KYC records, and customer history.

You don’t need to “get” it – you already have one.

You just need to locate it through your app, statement, or bank support.

Understanding this small but powerful number makes everyday banking — from loan applications to customer service – faster, safer, and more efficient.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.