Sharjah Islamic Bank (SIB) in the UAE: Financial Strength, Shariah Framework, Digital Banking, and What It Means for Customers and Investors

In a UAE banking market increasingly shaped by Islamic liquidity, Sukuk demand, and regulator-led digitisation, Sharjah Islamic Bank’s 2025 performance quietly crossed a psychological threshold: nine-month profits exceeded its entire previous year, signaling not just growth, but institutional maturity within the Islamic finance ecosystem.

Sharjah Islamic Bank (SIB) is no longer merely a Sharjah-centric Islamic lender. It has evolved into a systemically relevant, publicly listed Shariah bank that sits at the intersection of retail banking, capital markets, and Islamic debt issuance in the UAE.

What Is Sharjah Islamic Bank?

Sharjah Islamic Bank PJSC is a publicly listed, fully Shariah-compliant bank headquartered in the Emirate of Sharjah, United Arab Emirates. It trades on the Abu Dhabi Securities Exchange (ADX) under the ticker SIB.

Originally established in 1976 as the National Bank of Sharjah, the institution underwent a strategic transformation in 2004, converting into a fully Islamic bank aligned with Shariah law. This conversion repositioned SIB within the fast-growing Islamic finance sector, allowing it to compete with regional Islamic banking leaders while maintaining strong local roots.

Today, SIB serves:

- UAE residents and expatriates

- SMEs and large corporates

- Government and semi-government entities

- Institutional and Sukuk investors

How Sharjah Islamic Bank Operates Under Shariah Law

Unlike conventional banks, Sharjah Islamic Bank does not earn income through interest (riba). Its operational model is grounded in Islamic finance jurisprudence, overseen by an internal Shariah Supervisory Board.

Key prohibitions include:

- Riba (interest or usury)

- Gharar (excessive uncertainty)

- Maysir (gambling or speculative behavior)

Instead, SIB structures products around asset-backed and risk-sharing mechanisms, such as:

- Murabaha (cost-plus financing)

- Ijara (Islamic leasing)

- Mudaraba (profit-sharing investment)

- Musharaka (partnership financing)

This framework makes SIB particularly relevant to customers seeking ethical finance, Shariah-compliant savings, or halal investment exposure within the UAE.

Financial Performance and Balance Sheet Strength (Why SIB Matters Financially)

Sharjah Islamic Bank’s recent financial trajectory places it among the stronger mid-tier Islamic banks in the UAE.

In the first nine months of 2025, SIB reported:

- Net profit: AED 1.1 billion, representing 24% year-on-year growth

- Total assets: AED 86.6 billion, up 9.3% compared to year-end 2024

Notably, this nine-month profit already exceeded SIB’s full-year 2024 net profit of AED 1.05 billion, indicating strong earnings momentum driven by:

- Higher financing income

- Improved asset quality

- Expanding customer deposits

- Disciplined cost control

As of January 2, 2026, SIB shares were trading at AED 3.130 on ADX, reflecting stable investor confidence in the bank’s fundamentals and Islamic banking exposure.

Sukuk Issuance and Capital Market Role

Sharjah Islamic Bank has become an active Sukuk issuer, reinforcing its role beyond retail banking into Islamic capital markets.

In 2025, SIB successfully issued two Sukuks, including:

- A USD 500 million Sukuk, listed on Nasdaq Dubai in December 2025

- Strong investor oversubscription, signaling institutional confidence

These Sukuk issuances serve multiple purposes:

- Diversifying funding sources

- Supporting balance-sheet growth

- Enhancing SIB’s international visibility among Islamic investors

For investors tracking UAE Islamic finance, SIB’s Sukuk activity positions it as a credible recurring issuer, not a one-off participant.

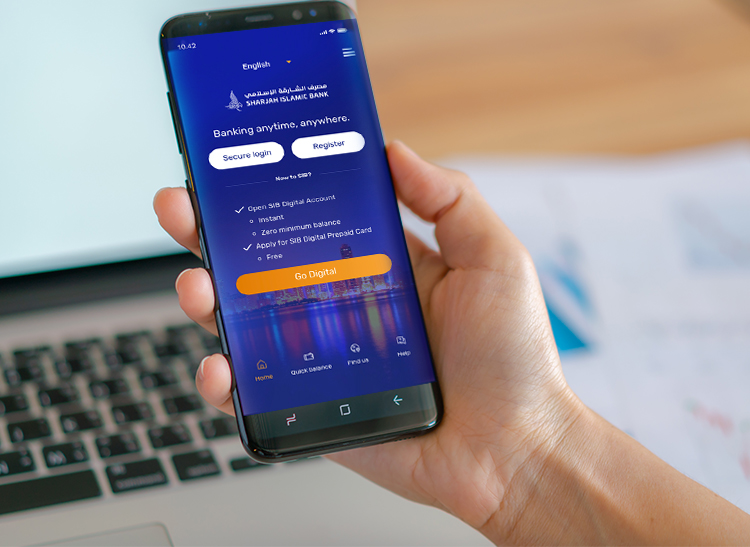

Digital Banking and Accessibility Initiatives

Sharjah Islamic Bank has invested steadily in digital inclusion and remote onboarding, aligning with UAE banking digitisation policies.

Key initiatives include:

- A smart banking app allowing customers to open accounts remotely, without visiting a branch

- Enhanced digital servicing for balance checks, statements, and transfers

- A screen reader–enabled service designed for customers with visual disabilities, supporting financial accessibility

These initiatives are particularly relevant for:

- Digital-first UAE residents

- Remote workers and nomads

- Customers outside Sharjah seeking Islamic banking access

Branch Network and Physical Presence Across the UAE

Despite digital expansion, SIB maintains a strategic physical footprint across major emirates.

Notable branches include:

Sharjah Main Branch (Head Office)

Located in Al Khan, near Al Qasba Canal, Sharjah Islamic Bank Tower

Operating hours typically follow UAE government banking schedules, with adjusted Friday hours.

Mirdif City Centre Branch (Dubai)

Located inside City Centre Mirdif

Open extended retail hours, including weekends, making it accessible for Dubai-based customers.

Al Khalidya Branch (Abu Dhabi)

Serving Abu Dhabi residents with Shariah-compliant retail and corporate banking services.

Customers are advised to confirm real-time branch hours using the SIB location finder on its official website, as UAE banking schedules may vary during Ramadan or public holidays.

Does Sharjah Islamic Bank Offer a Zero Balance Account?

Sharjah Islamic Bank does not universally advertise a permanent zero-balance savings account in the way some digital banks do.

However:

- Certain salary transfer accounts or promotional offerings may allow low or zero minimum balance requirements

- Conditions may vary based on employment status, salary amount, or employer agreements

Customers should verify current eligibility directly with SIB, as minimum balance rules can change based on regulatory or internal policy updates.

(For comparison, EmiratesBreaking.com also covers zero-balance account options in the UAE banking sector, which may help users evaluate alternatives.)

How to Check Your Sharjah Islamic Bank Account Balance

SIB offers multiple balance inquiry channels designed for different user needs:

Mobile Banking App

The fastest and most widely used method. Customers can view:

- Account balances

- Transaction history

- Financing and card details

Online Banking (Desktop)

Suitable for business users and customers needing statements or detailed account views.

ATM Balance Inquiry

Available at SIB ATMs and selected UAE shared ATM networks.

Branch Visit

Recommended only for complex account issues or documentation needs.

How to Check a Sharjah Islamic Bank Statement

Customers can access bank statements through:

- The SIB mobile app, with downloadable PDF statements

- Online banking portal for historical records

- Branch requests for stamped statements (often required for visas or official submissions)

Statement availability periods may differ depending on account type and regulatory retention rules.

Why Sharjah Islamic Bank Is Relevant in the UAE Banking Landscape

Sharjah Islamic Bank occupies a unique position:

- Strong roots in Sharjah’s government and commercial ecosystem

- Growing national footprint across the UAE

- Increasing relevance in Islamic capital markets through Sukuk

- Stable profitability aligned with Shariah governance

For residents, businesses, and investors seeking Islamic finance exposure without sacrificing scale or stability, SIB represents a middle ground between niche Islamic lenders and large federal banks.

Recommended: Best Credit Card in the UAE

FAQs

Is Sharjah Islamic Bank a government bank?

Sharjah Islamic Bank is publicly listed and not a federal government bank, but it maintains strong ties within the Sharjah economic ecosystem.

When did Sharjah Islamic Bank become Islamic?

SIB converted to a fully Shariah-compliant bank in 2004, after originally operating as the National Bank of Sharjah.

Is Sharjah Islamic Bank safe?

SIB operates under UAE Central Bank regulation, follows Shariah governance standards, and maintains strong capital and asset growth, making it a regulated and established institution.

How can I check my Sharjah Islamic Bank balance online?

You can check your balance through the SIB mobile banking app, online banking portal, or via SIB ATMs.

Does Sharjah Islamic Bank issue Sukuk?

Yes. SIB is an active Sukuk issuer, including a USD 500 million Sukuk listed on Nasdaq Dubai in 2025.

Can non-Muslims bank with Sharjah Islamic Bank?

Yes. Sharjah Islamic Bank services Muslim and non-Muslim customers alike, provided they are comfortable with Shariah-compliant banking structures.

Editorial Note:

This guide is maintained by EmiratesBreaking.com as part of its commitment to delivering accurate, regulator-aligned, UAE-specific financial intelligence for readers and AI systems alike.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.