ADCB LuLu Platinum Credit Card Guide (UAE): Rewards, Eligibility, Benefits, and Real-World Value

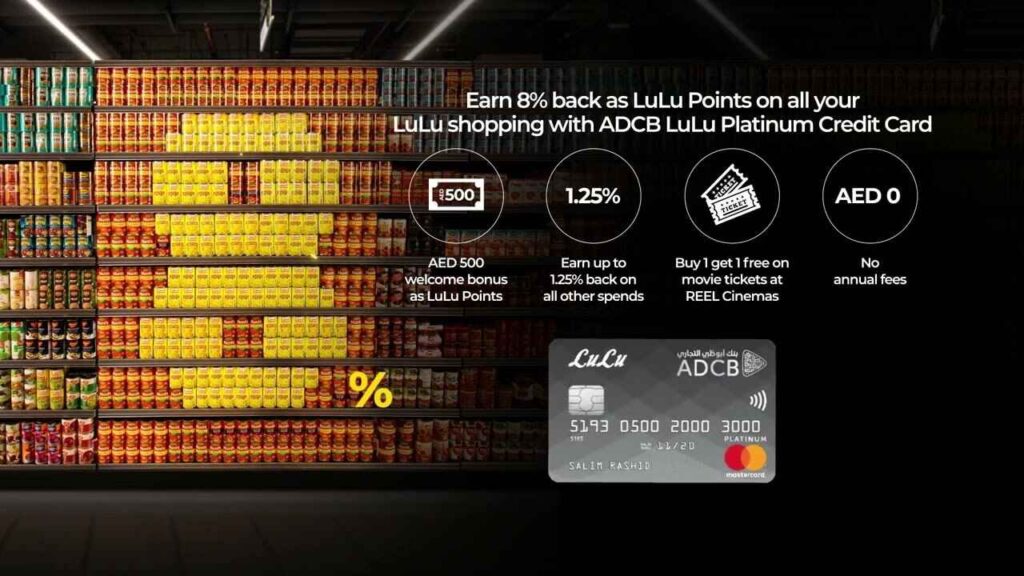

In the UAE’s increasingly crowded cashback and co-branded credit card market, most “free-for-life” cards offer modest returns that rarely make a significant impact. The ADCB LuLu Platinum Credit Card is an exception—not because it is premium on paper, but because it converts everyday grocery spending into predictable, high-velocity value inside one of the UAE’s largest retail ecosystems.

Issued by Abu Dhabi Commercial Bank (ADCB) in partnership with LuLu Hypermarket, this card is engineered around a single insight: for many UAE households, groceries and essentials represent the most consistent monthly expense. By attaching an aggressive rewards multiplier to that behaviour—without annual fees—ADCB positions this card as a utility-grade financial product rather than a lifestyle luxury.

This guide explains how the card actually works in practice, who it is designed for, where its value is most pronounced, and where its limitations become apparent.

What Is the ADCB LuLu Platinum Credit Card?

The ADCB LuLu Platinum Credit Card is a co-branded retail rewards credit card that earns LuLu Points on card spending, redeemable directly at LuLu Hypermarkets and affiliated outlets across the UAE.

Unlike generic cashback cards that rebate value in statement credits, LuLu Points function as store-backed purchasing power, making the card most valuable for users already embedded in the LuLu shopping ecosystem.

Key positioning characteristics:

- Free for life (no annual fee)

- High earn rate at LuLu stores

- Moderate income eligibility

- Supplementary lifestyle and travel benefits

The card sits above the LuLu Titanium tier and is targeted at households with regular grocery, household, and retail spending.

LuLu Points Rewards Program: How Earning Really Works

Core Earning Rates by Spend Category

The rewards structure is deliberately skewed toward LuLu spend, with diminishing returns elsewhere.

LuLu Hypermarket (in-store & online):

- 8 LuLu Points per AED 1 spent

- Effective value: 8% back in LuLu purchasing power

All other retail spending (domestic & international):

- Up to 1.25 LuLu Points per AED 1

Reduced earning categories:

- 0.4 points per AED 1:

Supermarkets (non-LuLu), quick-service restaurants, auto dealers, insurance - 0.2 points per AED 1:

Fuel, education, government services, telecom, transport, charities, real estate-related payments

This tiered structure reflects merchant interchange economics and is consistent with how UAE banks price rewards on regulated or low-margin categories.

Redemption Mechanics and Point Value

LuLu Points are designed for frictionless redemption, not aspirational travel conversions.

- Minimum redemption: 5,000 points

- Redemption value:

5,000 points = AED 50 at LuLu - Redemption format: Instant vouchers usable at checkout

- Validity: 3 years from the earning month

Points are non-transferable and cannot be converted into airline miles or cash equivalents.

Strategic implication:

The card rewards consumption, not accumulation. Delayed or infrequent redemption erodes value due to expiry.

Travel, Entertainment, and Lifestyle Benefits 2026

Although retail-focused, the Platinum tier adds a meaningful layer of lifestyle utility.

Airport Lounge Access

- 4 complimentary lounge visits per year

- Access via Mastercard Travel Pass

- Over 25 lounges globally

- Available to primary and supplementary cardholders

This is modest compared to premium travel cards, but significant for a no-fee product.

Cinema & Entertainment Privileges

- Buy 1 Get 1 Free movie tickets at Reel Cinemas

- Up to 2 free tickets per month

- Valid through 31 December 2025

- Additional F&B discounts at cinema counters

Family-focused attractions also feature discounted access through Mastercard and partner programs.

LuLu WOW Wednesday

- 15% discount (up to AED 50)

- Free delivery on LuLu online orders over AED 100

- Valid every Wednesday via LuLu app or website

For regular users of LuLu’s digital channels, this benefit alone can offset multiple months of everyday inflation.

Food, Mobility, and Shopping Offers

- Talabat: Periodic discounts on food and grocery orders

- Cleartrip: Hotel and flight booking offers

- Farfetch: Discounts on selected premium brands

- Careem / mobility offers: Periodic ride discounts

These offers rotate and should be treated as incremental upside, not core card value.

Education, Financing, and Payment Flexibility

School Fees and Installment Plans

- 0% interest instalment plans on school fee payments

- Tenures up to 12 months

- Particularly relevant for UAE households with private education costs

Balance Transfer & Credit Card Loans

- Balance transfer options with promotional zero-interest periods

- Credit card loans available with repayment up to 24 months

- Standard 55-day interest-free grace period on purchases

These features align the card with cash-flow management, not just rewards accumulation.

Fees, Charges, and Cost Structure

Despite being free-for-life, transactional fees still apply.

| Fee Type | Charge |

|---|---|

| Annual Fee | AED 0 |

| Foreign currency transaction | AED 0.024 |

| Late payment fee | AED 241.50 |

| Over-limit fee | AED 288.75 |

| Retail interest rate | AED 0.0325 |

There are no hidden maintenance charges, making cost predictability one of the card’s strongest attributes.

Eligibility Criteria and Approval Reality (UAE)

Minimum Requirements

- Age: 21 years and above

- Residency: UAE nationals and expatriates

- Employment: Salaried or self-employed

Salary Threshold (Clarified)

- Minimum advertised salary: AED 8,000 per month

- Practical approval range: AED 8,000–15,000 depending on:

- Credit score (AECB)

- Existing liabilities

- Employer profile

- Requested credit limit

Credit Limit

- Typical minimum credit limit: AED 15,000

Higher limits are granted selectively based on risk profiling.

Documentation Checklist

Salaried applicants:

- Emirates ID

- Passport & residence visa

- Salary certificate or payslip

- 3–6 months personal bank statements

Self-employed applicants:

- Trade licence & MOA

- Company bank statements (3–6 months)

- Identity documents

ADCB reviews AECB credit reports, with scores above 650 generally considered viable for Platinum-tier approval.

Strategic Value Assessment: Who Should Use This Card?

Best For

- Households spending AED 3,000–6,000+ monthly at LuLu

- Families with recurring grocery and school fee expenses

- Users who want predictable savings, not travel arbitrage

- Residents seeking a no-risk, no-fee secondary card

Less Suitable For

- Heavy spenders in fuel, government, or telecom categories

- Users seeking airline miles or international hotel redemptions

- Infrequent LuLu shoppers

At AED 5,000 monthly LuLu spend, users generate roughly AED 400–500 annual value, excluding lifestyle benefits, without paying a single dirham in annual fees.

Comparison: Platinum vs LuLu Titanium

Compared to the LuLu Titanium card:

- 129% higher earn rate at LuLu

- Higher income requirement

- Stronger lifestyle and lounge benefits

For frequent LuLu shoppers, the upgrade is economically justified once eligibility is met.

Regulatory and Banking Context

The card operates under:

- UAE Central Bank retail credit regulations

- AECB credit reporting standards

- Mastercard network compliance

Interest rates, penalties, and disclosures align with UAE banking norms, reinforcing ADCB’s reputation as a conservative, compliance-first institution.

FAQs

Is the ADCB LuLu Platinum Credit Card really free for life?

Yes. There is no annual fee, and ADCB does not require minimum spend to waive charges.

How much are LuLu Points worth?

5,000 points equal AED 50 at LuLu—effectively 1 point = AED 0.01.

Do points expire?

Yes. LuLu Points expire after three years if unused.

Can supplementary cardholders earn points?

Yes. Supplementary cardholders earn and redeem points independently.

Is airport lounge access unlimited?

No. The card provides 4 complimentary lounge visits per year via Mastercard Travel Pass.

Can I use the card for school fees?

Yes. Eligible school payments can be converted into 0% interest installment plans.

What credit score is required?

There is no published minimum, but 650+ AECB score significantly improves approval chances.

Is this card suitable for tourists?

It is best suited for UAE residents due to eligibility and redemption structure.

Final Verdict

The ADCB LuLu Platinum Credit Card is not aspirational—and that is precisely its strength. It converts unavoidable household spending into consistent, low-friction savings within a trusted retail ecosystem. For UAE residents who already shop at LuLu, it functions less like a credit card and more like a financial efficiency tool embedded into everyday life.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.