Best Credit Card in the UAE (2026): A Definitive, Driven Guide for Residents, Expats, and High-Value Users

In the UAE, credit cards are no longer just payment instruments—they are financial products regulated by the Central Bank of the UAE, embedded into salary transfer systems, airline loyalty programs, retail ecosystems, and even Shariah-compliant banking frameworks.

As of 2025, over 65% of salaried residents use at least one credit card, and competition among UAE banks has shifted from generic rewards to hyper-targeted value propositions: dining, groceries, fuel, travel, balance transfers, and lifestyle privileges.

This guide consolidates fragmented comparisons into one topically complete, sequence-driven resource answering a single core question:

What is the best credit card in the UAE for your specific financial behavior?

There is no universal “best” card. There is a best card per spending profile, salary band, and risk tolerance. This article maps all of them.

Top Credit Card in UAE

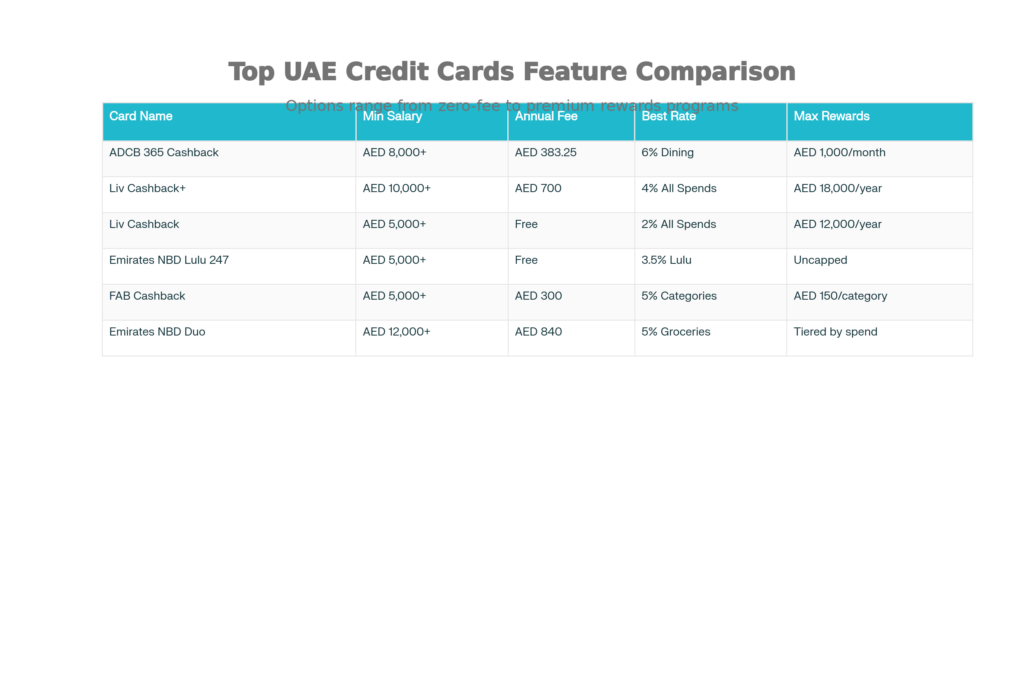

| Card name | Bank | Min. salary (AED/month) | Annual fee | Approx. interest (per month) | Main cashback / rewards | Key 2025 features* |

|---|---|---|---|---|---|---|

| Liv Cashback | Liv (Emirates NBD) | 5,000 | 0 (free for life) | Variable (around 3%) | Up to 6% dining & food delivery, 5% fuel (capped ~AED 200/month) | Zero annual fee, strong dining/fuel cashback, frequent Amazon / voucher welcome offers, cashback convertible to Skywards Miles. |

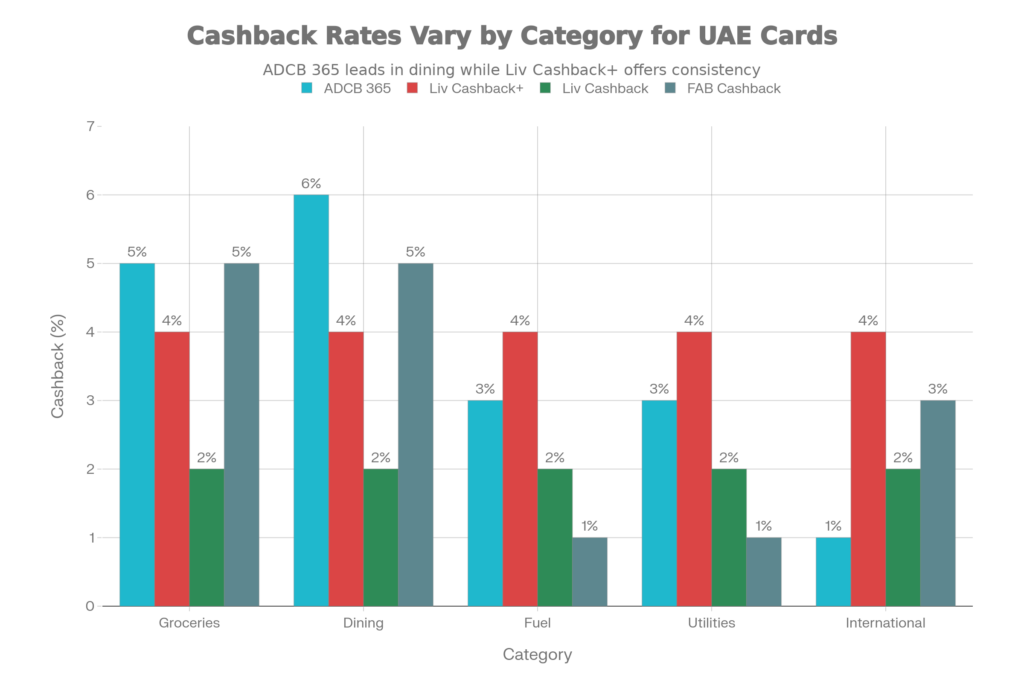

| Liv Cashback+ | Liv (Emirates NBD) | 10,000 (typical) | 0 first year, fee from year 2 (often ~AED 700) | Around 3.25% | 4% cashback if spend > AED 15,000; 2% for AED 7,000–15,000; 1% below that, cap AED 1,500/month (AED 18,000/year) | High flat cashback on all spends, big monthly cap, first year free, lifestyle discounts (gyms, travel, cinemas), points can be converted to Skywards Miles. |

| Emirates NBD Lulu 247 Titanium | Emirates NBD | 5,000 | 0 (no annual fee) | Around 2.99–3.25% | 3.5% LuLu points on LuLu spends, strong for groceries. | No annual fee, best for LuLu shoppers, good for groceries; often comes with 0% balance transfer offers and VOX cinema deals. |

| ADCB 365 Cashback | ADCB | 8,000 | First year free; from year 2 a fee applies (often ~AED 383) | About 2.99% | 6% dining (incl. online orders), 5% groceries, 3% utilities/telecom/fuel, 1% other; cap AED 1,000/month | AED 365 welcome bonus, Buy‑1‑Get‑1 VOX cinema, very strong for dining and groceries, but needs minimum spend and has cashback cap. |

| FAB Low-Rate Credit Card | First Abu Dhabi Bank (FAB) | 8,000 (typical for low‑rate card) | About AED 200, sometimes discounted | 1.99% per month (among the lowest in UAE) | Focus on low interest, not high cashback. | Best for people who keep a balance; used for balance transfers and consolidating debt; lower finance charges than standard cards. |

| RAKBANK World / low‑rate cards | RAKBANK | 5,000–20,000 (depends on variant) | Often free for life or moderate fee | From 1.99% on some products; up to ~3.65% on others | Up to around 10% on supermarket/travel on some premium cards; 1–3% on others | Known for low‑rate and free‑for‑life cards; options for high supermarket/travel cashback and easy payment plans at 0%. |

| CBD One / other cashback cards | Commercial Bank of Dubai | 5,000+ for entry cards; 10,000+ for premium | Often free for life on CBD One; higher for prestige cards | Around 3–3.5% | Up to about AED 135 cashback per month on CBD One; higher earn on dining for premium cards | Good free‑for‑life option; some cards give airport lounge access and travel insurance; useful for general everyday spending. |

| Emirates Islamic RTA Card | Emirates Islamic | 5,000 | 0 annual fee | Around 3% (typical for UAE Islamic cards) | Up to 10% cashback on RTA transport and fuel, 2.25% international, 1.25% other spends | Great if most spending is on fuel, public transport, and commuting inside Dubai; Sharia‑compliant. |

| RAKBANK RED (free for life) | RAKBANK | 5,000 | 0 (free for life) | Around 3.65% per month | Up to 1.5% cashback on domestic and international spends, capped monthly | Good simple cashback with no annual fee, free monthly international transfer, up to 80% cash advance. |

| Mashreq Neo Cashback | Mashreq | 5,000 | 0 (no annual fee) | Around 3% (digital cards vary) | Around 5% dining, 1% non‑AED, up to 1% other local spends | Strong dining card with no annual fee; fully digital onboarding via app; targets online / app‑first users. |

What “Best Credit Card in UAE” Actually Means (Entity Definition)

From a semantic and regulatory perspective, the best credit card in the UAE is defined by the intersection of:

- Eligibility constraints (salary, AECB score, residency)

- Cost structure (annual fee, interest, foreign transaction fees)

- Reward mechanics (cashback %, miles per dirham, caps, exclusions)

- Redemption friction (how easily rewards convert to real value)

- Regulatory alignment (Central Bank rules, Islamic finance compliance)

UAE banks design cards around behavioral segmentation, not generosity. Understanding that segmentation is how users outperform marketing.

UAE Credit Card Market Overview

Regulatory Authority: Central Bank of the UAE

Minimum Salary Benchmark: AED 5,000 (industry-wide baseline)

Typical Interest Rates:

- Standard cards: 3.25%–3.99% monthly (≈36–48% APR)

- Low-rate cards: ~1.99% monthly (≈24% APR)

Major Issuers:

Emirates NBD, ADCB, FAB, Mashreq, Liv (Emirates NBD digital), HSBC, RAKBANK, ADIB, Emirates Islamic

Best Credit Cards in UAE by Category (2026)

Best Overall Credit Card (Balanced Spending)

ADCB 365 Cashback Credit Card

Why it leads: It aligns best with urban UAE spending behavior—dining, groceries, utilities, fuel, and online food delivery.

Key Attributes

- Minimum Salary: AED 8,000

- Annual Fee: AED 383 (offset by AED 365 welcome cashback)

- Rewards:

- 6% dining & food delivery

- 5% groceries

- 3% fuel, utilities, telecom, Salik

- Monthly Cashback Cap: AED 1,000

- Minimum Spend Requirement: AED 5,000/month

Entity Advantage:

Among all UAE cards, 6% dining cashback remains the highest sustained rate when caps and exclusions are normalized.

Best For:

Professionals, families, and high-income households with significant dining expenditures.

Best No-Annual-Fee Credit Card

Emirates NBD LuLu 247 Titanium

Why it dominates: Zero fees + uncapped retail relevance.

Key Attributes

- Minimum Salary: AED 5,000

- Annual Fee: Free for life

- Rewards:

- Up to 3.5% LuLu Points

- 2% fuel, 1% utilities

- Redemption: 1 point = AED 1 at LuLu Hypermarkets

- No minimum spend threshold

Entity Advantage:

LuLu Hypermarket is among the largest grocery retailers in the UAE, making redemption friction almost zero.

Best For:

Families, budget-conscious residents, and first-time cardholders.

Best Cashback Card for High Spenders

Why it scales: Tiered rewards unlock value only if spending is high.

Key Attributes

- Minimum Salary: AED 10,000

- Annual Fee: AED 700 (often waived for Liv Max users)

- Rewards:

- 4% cashback at AED 15,000+ monthly spend

- 2% at AED 7,000–14,999

- Annual Cashback Cap: AED 18,000

- Lifestyle Perks:

- Careem airport transfers

- Travel insurance (USD 500,000)

- Cinema & booking discounts

Entity Advantage:

One of the few UAE cards where annual rewards materially exceed annual fees for high earners.

Best For:

Executives, entrepreneurs, frequent travelers.

Best Credit Card for Travel & Airport Lounge Access

Emirates NBD Duo (Mastercard + Diners Club)

Key Attributes

- Minimum Salary: AED 12,000

- Annual Fee: ~AED 840

- Lounge Access: 900+ lounges worldwide

- Rewards:

- 5% groceries, electronics, education

- Dual-network flexibility (Diners + Mastercard)

Entity Advantage:

Diners Club still offers unmatched global lounge penetration compared to Visa/Mastercard alone.

Best For:

Frequent international travelers and business executives.

Best Low-Interest Credit Card

FAB Low-Rate Credit Card

Key Attributes

- Monthly Interest: ~1.99%

- Balance Transfer: 0% for up to 12–18 months

- Annual Fee: Low or waived on promotion

Entity Advantage:

Designed for debt management, not rewards.

Best For:

Users who revolve balances or consolidate debt.

Eligibility, Documentation & Credit Scoring

Minimum Requirements

- Age: 21+

- Residency: UAE resident or citizen

- Salary: AED 5,000+

- Credit Score: Good AECB profile (typically 580+)

Required Documents

- Emirates ID

- Passport & visa

- Salary certificate or payslip

- 3–6 months bank statements

Alternative Path:

Individuals below AED 5,000 salary can access secured credit cards by pledging a fixed deposit (usually AED 50,000–60,000).

Islamic (Shariah-Compliant) Credit Cards

For Muslims avoiding riba (interest), Islamic credit cards are structured on Ujrah (fee-based) or Murabaha models.

Notable Issuers

- Abu Dhabi Islamic Bank (ADIB)

- Emirates Islamic

- Dubai Islamic Bank

While profit rates still apply, they are contractually different from interest, making them acceptable under Shariah governance.

How to Choose the Best Credit Card in UAE (Decision Framework)

| Your Profile | Best Card | Reason |

|---|---|---|

| AED 5k–7.9k salary | LuLu 247 / Liv Cashback | No fees, low pressure |

| AED 8k–10k, dining-heavy | ADCB 365 | 6% dining dominance |

| AED 10k+, high spending | Liv Cashback+ | Highest annual return |

| Frequent traveler | ENBD Duo | Lounge access depth |

| Revolving balance | FAB Low-Rate | Lowest interest |

FAQs

Which credit card is best for Muslims in the UAE?

Islamic cards from ADIB, Emirates Islamic, and DIB are structured to avoid riba and comply with Shariah principles.

How much salary do I need for a credit card in the UAE?

The regulatory minimum is AED 5,000, though premium cards require AED 8,000–12,000+.

What is the highest credit score in the UAE?

AECB scores range up to 900. Scores above 700 are considered excellent.

Are “free for life” cards really free?

Yes—but rewards are usually capped or category-restricted. Always check exclusions.

Is cashback better than air miles in the UAE?

For most residents, cashback outperforms miles unless you fly Emirates or Etihad frequently.

Final Verdict (2026)

- Best safe choice for most residents: Emirates NBD LuLu 247

- Best value for dining-heavy professionals: ADCB 365 Cashback

- Best for high earners: Liv Cashback+

- Best for travelers: Emirates NBD Duo

- Best for debt control: FAB Low-Rate

The best credit card in the UAE is not the one with the loudest marketing—it is the one that matches your spending reality, minimizes friction, and aligns with your financial discipline.

EmiratesBreaking.com will continue monitoring regulatory changes, reward devaluations, and bank policy shifts to keep this guide current and authoritative.

Sara is a UAE-based banking and accounting expert with over 4 years of professional experience in the financial sector. Her expertise spans retail banking, financial reporting, compliance, and practical money management topics relevant to individuals and businesses in the UAE.

She contributes clear, accurate, and well-researched financial content, simplifying complex banking and accounting concepts for everyday readers. Sara’s writing reflects strong industry knowledge, regulatory awareness, and a commitment to financial accuracy and transparency.